StandardBarrier

Updated: 31 Oct 2013

Use StandardBarrier to calculate the price or Greeks of a European-style Knock-In or Knock-Out option. StandardBarrier valuations are based on the formulae published by Mark Rubinstein and Eric Reiner in 1991.

Syntax

SELECT [wctOptions].[wct].[StandardBarrier](

<@CallPut, nvarchar(4000),>

,<@BarrierType, nvarchar(4000),>

,<@AssetPrice, float,>

,<@StrikePrice, float,>

,<@BarrierPrice, float,>

,<@Rebate, float,>

,<@TimeToMaturity, float,>

,<@RiskFreeRate, float,>

,<@DividendRate, float,>

,<@Volatility, float,>

,<@ReturnValue, nvarchar(4000),>)

Arguments

@CallPut

identifies the option as being a call ('C') or a put ('P'). @CallPut is an expression of type nvarchar or of a type that can be implicitly converted to nvarchar.

@BarrierType

identifies the type of barrier as 'UI' (Up-and-In), 'UO' (Up-and-Out), 'DI' (Down-and-In), or 'DO' (Down-and-out). @BarrierType must be of a type nvarchar or of a type that implicitly converts to nvarchar.

@AssetPrice

the price of the underlying asset. @AssetPrice is an expression of type float or of a type that can be implicitly converted to float.

@StrikePrice

the exercise price of the option. @StrikePrice is an expression of type float or of a type that can be implicitly converted to float.

@BarrierPrice

For a knock-in option, @BarrierPrice is the value at which the option comes into existence if the @AssetPrice crosses the barrier. For a knock-out option, @BarrierPrice is the value at which the option is extinguished if the @AssetPrice crosses the barrier. @BarrierPrice must be of a type float or of a type that implicitly converts to float.

@Rebate

An amount paid to the buyer of the option in the event that the barrier is never breached. @Rebate must be of a type float or of a type that implicitly converts to float.

@TimeToMaturity

the time to expiration of the option, expressed in years. @TimeToMaturity is an expression of type float or of a type that can be implicitly converted to float.

@RiskFreeRate

the continuously compounded zero coupon risk-free rate over the life of the option. @RiskFreeRate is an expression of type float or of a type that can be implicitly converted to float.

@DividendRate

the continuously compounded zero coupon dividend rate over the life of the option. For currency options @DividendRate should be the foreign risk-free zero coupon rate. @DividendRate is an expression of type float or of a type that can be implicitly converted to float.

@Volatility

the volatility of the relative price change of the underlying asset. @Volatility is an expression of type float or of a type that can be implicitly converted to float.

@ReturnValue

identifies the calculation to be performed. @ReturnValue is an expression of type nvarchar or of a type that can be implicitly converted to nvarchar. For a full description of the return values, see StandardBarrierPriceNGreeks. @ReturnValue is not case-sensitive. The following values are acceptable for @ReturnValue

|

@ReturnValue

|

Returns

|

|

'P','PRICE'

|

Price

|

|

'D','DELTA'

|

Delta

|

|

'G','GAMMA'

|

Gamma

|

|

'T','THETA'

|

Theta

|

|

'V','VEGA'

|

Vega

|

|

'R','RHO'

|

Rho

|

|

'L','LAMBDA'

|

Lambda

|

|

'DDDV','VANNA','DVEGADSPOT','DDELTADVOL'

|

DdeltaDvol

|

|

'DVV','DDELTADVOLDVOL'

|

DdeltaDvolDvol

|

|

'DT','CHARM','DDELTADTIME'

|

DdeltaDtime

|

|

'GV','ZOMMA','DGAMMADVOL'

|

DgammaDvol

|

|

'GP','GAMMAP'

|

GammaP

|

|

'DVDV','VOMMA','VOLGA','DVEGADVOL'

|

DvegaDvol

|

|

'VP','VEGAP'

|

VegaP

|

|

'PR2','PHIRHO2'

|

PhiRho2

|

|

'S','SPEED','DGAMMADSPOT'

|

DgammaDspot

|

|

'DX','DELTAX'

|

Delta X

|

|

'GX','GAMMAX','DX','RND','RISKNEUTRALDENSITY'

|

Risk Neutral Density

|

|

'VVV','ULTIMA','DVOMMADVOL'

|

DvommaDvol

|

|

'VT','VETA','DVEGADTIME'

|

DvegaDtime

|

|

'GT','COLOR','DGAMMADTIME'

|

DgammaDtime

|

|

'FR','RHOFUTURESOPTIONS','FUTURESOPTIONSRHO'

|

Futures Options Rho

|

|

'B','CARRYSENSITIVITY'

|

Carry Sensitivity

|

Return Type

float

Remarks

· @Volatility must be greater than zero (@Volatility > 0).

· @TimeToMaturity must be greater than zero (@TimeToMaturity > 0).

· @AssetPrice must be greater than zero (@AssetPrice > 0).

· @StrikePrice must be greater than zero (@StrikePrice > 0).

· If @ReturnValue is NULL, then @ReturnValue is set to 'P'.

· If @DividendRate is NULL then @DividendRate = 0.

· If @RiskFreeRate is NULL @RiskFreeRate = 0.

· @BarrierPrice must be greater than zero (@BarrierPrice > 0).

· @Rebate must be greater than or equal to zero (@Rebate >= 0).

· If @Rebate is NULL, then @Rebate = 0.

· @BarrierPrice assumes continuous monitoring.

· To convert a non-continuous @BarrierPrice use the AdjustedBarrier function.

Example

A down-and-in call

SELECT cast(wct.StandardBarrier(

'C' --PutCall

,'DI' --BarrierType

,100 --Asset Price

,90 --Strike Price

,97 --Barrier

,2 --Rebate

,0.5 --Time-to-expiry

,.10 --Risk Free Rate

,.05 --Dividend Rate

,.20 --Volatility

,'P' --Return Value

) as money) as Price

This produces the following result.

Price

---------------------

8.5951

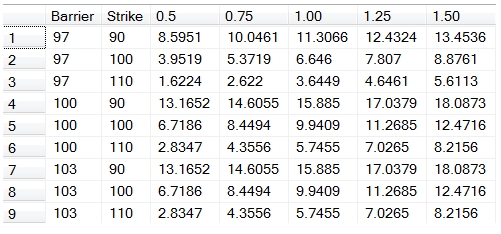

This SELECT statement reproduces the table for a down-and-in call included in the original paper on Barrier Options by Rubinstein and Reiner, though the numerical values are different.

SELECT *

FROM (

SELECT n.t

,n3.Barrier

,n2.Strike

,cast(wct.StandardBarrier(

'C' --PutCall

,'DI' --BarrierType

,100 --Asset Price

,n2.Strike --Strike Price

,n3.Barrier --Barrier

,2 --Rebate

,n.t --Time-to-expiry

,.10 --Risk Free Rate

,.05 --Dividend Rate

,.20 --Volatility

,'P' --Return Value

) as money) as Price

FROM (VALUES (0.5),(0.75),(1.00),(1.25),(1.50))n(t)

CROSS APPLY(VALUES (90),(100),(110))n2(Strike)

CROSS APPLY(VALUES (97),(100),(103))n3(Barrier)

) D

PIVOT(SUM(Price) for t in([0.5],[0.75],[1.00],[1.25],[1.50])) as P

ORDER BY 1,2

This produces the following result.

We can reproduce the table in its entirety with the following SQL.

SELECT *

FROM (

SELECT n.t

,n5.Z

,n4.BarrierType

,n3.Barrier

,n2.Strike

,cast(wct.StandardBarrier(

n5.Z

,n4.BarrierType

,100

,n2.Strike

,n3.Barrier

,2

,n.t

,.10

,.05

,.20

,'P'

) as money) as Price

FROM (VALUES (0.5),(0.75),(1.00),(1.25),(1.50))n(t)

CROSS APPLY(VALUES (90),(100),(110))n2(Strike)

CROSS APPLY(VALUES (97),(100),(103))n3(Barrier)

CROSS APPLY(VALUES ('UI'),('DI'),('UO'),('DO'))n4(BarrierType)

CROSS APPLY(VALUES ('C'),('P'))n5(Z)

) D

PIVOT(SUM(Price) for t in([0.5],[0.75],[1.00],[1.25],[1.50])) as P

ORDER BY 1,2

Here are the results of this query, reformatted for ease of viewing.

|

Z

|

BarrierType

|

Barrier

|

Strike

|

0.5

|

0.75

|

1

|

1.25

|

1.5

|

|

C

|

DI

|

97

|

90

|

8.5951

|

10.0461

|

11.3066

|

12.4324

|

13.4536

|

|

C

|

DI

|

97

|

100

|

3.9519

|

5.3719

|

6.6460

|

7.8070

|

8.8761

|

|

C

|

DI

|

97

|

110

|

1.6224

|

2.6220

|

3.6449

|

4.6461

|

5.6113

|

|

C

|

DI

|

100

|

90

|

13.1652

|

14.6055

|

15.8850

|

17.0379

|

18.0873

|

|

C

|

DI

|

100

|

100

|

6.7186

|

8.4494

|

9.9409

|

11.2685

|

12.4716

|

|

C

|

DI

|

100

|

110

|

2.8347

|

4.3556

|

5.7455

|

7.0265

|

8.2156

|

|

C

|

DI

|

103

|

90

|

13.1652

|

14.6055

|

15.8850

|

17.0379

|

18.0873

|

|

C

|

DI

|

103

|

100

|

6.7186

|

8.4494

|

9.9409

|

11.2685

|

12.4716

|

|

C

|

DI

|

103

|

110

|

2.8347

|

4.3556

|

5.7455

|

7.0265

|

8.2156

|

|

C

|

DO

|

97

|

90

|

6.5391

|

6.5202

|

6.5324

|

6.5534

|

6.5761

|

|

C

|

DO

|

97

|

100

|

4.7357

|

5.0383

|

5.2488

|

5.4093

|

5.5379

|

|

C

|

DO

|

97

|

110

|

3.1813

|

3.6944

|

4.0545

|

4.3283

|

4.5467

|

|

C

|

DO

|

100

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

DO

|

100

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

DO

|

100

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

DO

|

103

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

DO

|

103

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

DO

|

103

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UI

|

97

|

90

|

13.1652

|

14.6055

|

15.8850

|

17.0379

|

18.0873

|

|

C

|

UI

|

97

|

100

|

6.7186

|

8.4494

|

9.9409

|

11.2685

|

12.4716

|

|

C

|

UI

|

97

|

110

|

2.8347

|

4.3556

|

5.7455

|

7.0265

|

8.2156

|

|

C

|

UI

|

100

|

90

|

13.1652

|

14.6055

|

15.8850

|

17.0379

|

18.0873

|

|

C

|

UI

|

100

|

100

|

6.7186

|

8.4494

|

9.9409

|

11.2685

|

12.4716

|

|

C

|

UI

|

100

|

110

|

2.8347

|

4.3556

|

5.7455

|

7.0265

|

8.2156

|

|

C

|

UI

|

103

|

90

|

13.1937

|

14.6826

|

15.9732

|

17.1263

|

18.1724

|

|

C

|

UI

|

103

|

100

|

6.9961

|

8.6648

|

10.1186

|

11.4202

|

12.6039

|

|

C

|

UI

|

103

|

110

|

3.1155

|

4.5728

|

5.9244

|

7.1789

|

8.3485

|

|

C

|

UO

|

97

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

97

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

97

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

100

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

100

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

100

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

C

|

UO

|

103

|

90

|

1.9443

|

1.8895

|

1.8736

|

1.8692

|

1.8690

|

|

C

|

UO

|

103

|

100

|

1.6954

|

1.7512

|

1.7840

|

1.8060

|

1.8218

|

|

C

|

UO

|

103

|

110

|

1.6920

|

1.7494

|

1.7829

|

1.8052

|

1.8212

|

|

P

|

DI

|

97

|

90

|

1.6063

|

2.0797

|

2.4544

|

2.7503

|

2.9845

|

|

P

|

DI

|

97

|

100

|

4.6684

|

5.1991

|

5.5574

|

5.8050

|

5.9752

|

|

P

|

DI

|

97

|

110

|

10.0441

|

10.2427

|

10.3199

|

10.3241

|

10.2785

|

|

P

|

DI

|

100

|

90

|

1.2449

|

1.7829

|

2.1974

|

2.5213

|

2.7767

|

|

P

|

DI

|

100

|

100

|

4.3106

|

4.9043

|

5.3017

|

5.5769

|

5.7680

|

|

P

|

DI

|

100

|

110

|

9.9390

|

10.0879

|

10.1547

|

10.1598

|

10.1191

|

|

P

|

DI

|

103

|

90

|

1.2449

|

1.7829

|

2.1974

|

2.5213

|

2.7767

|

|

P

|

DI

|

103

|

100

|

4.3106

|

4.9043

|

5.3017

|

5.5769

|

5.7680

|

|

P

|

DI

|

103

|

110

|

9.9390

|

10.0879

|

10.1547

|

10.1598

|

10.1191

|

|

P

|

DO

|

97

|

90

|

1.6076

|

1.6641

|

1.6970

|

1.7189

|

1.7347

|

|

P

|

DO

|

97

|

100

|

1.6112

|

1.6660

|

1.6982

|

1.7198

|

1.7353

|

|

P

|

DO

|

97

|

110

|

1.8639

|

1.8060

|

1.7887

|

1.7837

|

1.7830

|

|

P

|

DO

|

100

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

DO

|

100

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

DO

|

100

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

DO

|

103

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

DO

|

103

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

DO

|

103

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UI

|

97

|

90

|

1.2449

|

1.7829

|

2.1974

|

2.5213

|

2.7767

|

|

P

|

UI

|

97

|

100

|

4.3106

|

4.9043

|

5.3017

|

5.5769

|

5.7680

|

|

P

|

UI

|

97

|

110

|

9.9390

|

10.0879

|

10.1547

|

10.1598

|

10.1191

|

|

P

|

UI

|

100

|

90

|

1.2449

|

1.7829

|

2.1974

|

2.5213

|

2.7767

|

|

P

|

UI

|

100

|

100

|

4.3106

|

4.9043

|

5.3017

|

5.5769

|

5.7680

|

|

P

|

UI

|

100

|

110

|

9.9390

|

10.0879

|

10.1547

|

10.1598

|

10.1191

|

|

P

|

UI

|

103

|

90

|

0.8615

|

1.2201

|

1.5475

|

1.8292

|

2.0671

|

|

P

|

UI

|

103

|

100

|

2.7722

|

3.3936

|

3.8471

|

4.1857

|

4.4412

|

|

P

|

UI

|

103

|

110

|

7.0001

|

7.4930

|

7.8069

|

8.0072

|

8.1283

|

|

P

|

UO

|

97

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

97

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

97

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

100

|

90

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

100

|

100

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

100

|

110

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

2.0000

|

|

P

|

UO

|

103

|

90

|

2.3562

|

2.5295

|

2.6117

|

2.6497

|

2.6637

|

|

P

|

UO

|

103

|

100

|

3.5112

|

3.4773

|

3.4164

|

3.3488

|

3.2809

|

|

P

|

UO

|

103

|

110

|

4.9117

|

4.5616

|

4.3095

|

4.1103

|

3.9448

|

To calculate the delta for the first option:

SELECT wct.StandardBarrier(

'C' --PutCall

,'DI' --BarrierType

,100 --Asset Price

,90 --Strike Price

,97 --Barrier

,2 --Rebate

,0.5 --Time-to-expiry

,.10 --Risk Free Rate

,.05 --Dividend Rate

,.20 --Volatility

,'D' --Return Value

) as Delta

This produces the following result.

Delta

----------------------

-0.649025843078022

In this example we show all of the return values for an option (which can be more easily done using StandardBarrierPriceNGreeks).

SELECT n.rv as Description

,wct.StandardBarrier('C','DI',100,90,97,2,0.5,.10,.05,.20,n.rv) as Value

FROM (

SELECT 'Price' UNION ALL

SELECT 'Delta' UNION ALL

SELECT 'Gamma' UNION ALL

SELECT 'GammaX' UNION ALL

SELECT 'Theta' UNION ALL

SELECT 'Vega' UNION ALL

SELECT 'Rho' UNION ALL

SELECT 'RhoFuturesOption' UNION ALL

SELECT 'Lambda' UNION ALL

SELECT 'DdeltaDvol' UNION ALL

SELECT 'DdeltaDvolDvol' UNION ALL

SELECT 'DdeltaDtime' UNION ALL

SELECT 'DgammaDvol' UNION ALL

SELECT 'GammaP' UNION ALL

SELECT 'DvegaDvol' UNION ALL

SELECT 'VegaP' UNION ALL

SELECT 'PhiRho2' UNION ALL

SELECT 'CarrySensitivity' UNION ALL

SELECT 'DgammaDspot' UNION ALL

SELECT 'DeltaX' UNION ALL

SELECT 'DvommaDvol' UNION ALL

SELECT 'DvegaDtime' UNION ALL

SELECT 'DgammaDtime')n(rv)

This produces the following result.

Description Value

---------------- ----------------------

Price 8.59507043337689

Delta -0.649025843078022

Gamma 0.052092730129516

GammaX 0.0207577954824956

Theta -0.0173153378580135

Vega 0.258665904443234

Rho 0.156984606562283

RhoFuturesOption -0.0379626818828527

Lambda -7.55114048347627

DdeltaDvol 0.0135552546964846

DdeltaDvolDvol -0.650285444002208

DdeltaDtime 0.000306086723699144

DgammaDvol -0.00416152983184759

GammaP 0.052092730129516

DvegaDvol -0.00199687541169169

VegaP 0.517331808886468

PhiRho2 -0.199959958365525

CarrySensitivity 0.199959958365525

DgammaDspot 12980.5178819264

DeltaX -0.582783834275347

DvommaDvol 0.000564868690799969

DvegaDtime -0.0699760427380625

DgammaDtime -5.04370755206702E-05