PRICEMAT

Updated: 10 October 2014

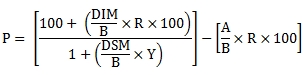

Use the scalar function PRICEMAT to calculate the price (expressed per 100 par value) of a security that pays interest at maturity. The PRICEMAT formula is:

Where:

|

A

|

=

|

Number of days from issue date to settlement date

|

|

B

|

=

|

Number of days in the year

|

|

DIM

|

=

|

Number of days from issue date to maturity date

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

R

|

=

|

Annual interest rate in decimal terms

|

|

Y

|

=

|

Annual Yield

|

Syntax

SELECT [westclintech].[wct].[PRICEMAT] (

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Issue, datetime,>

,<@Rate, float,>

,<@Yld, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date of the security. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the security. @Maturity is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Issue

the issue date of the security. @Issue is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Rate

the security’s annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yld

the security’s annual yield. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

@Basis

|

Day count basis

|

|

0, 'BOND'

|

US (NASD) 30/360

|

|

1, 'ACTUAL'

|

Actual/Actual

|

|

2, 'A360'

|

Actual/360

|

|

3, 'A365'

|

Actual/365

|

|

4, '30E/360 (ISDA)', '30E/360', 'ISDA', '30E/360 ISDA', 'EBOND'

|

European 30/360

|

|

5, '30/360', '30/360 ISDA', 'GERMAN'

|

30/360 ISDA

|

|

7, 'NL/365'

|

No Leap Year /365

|

|

8, 'NL/360'

|

No Leap Year /360

|

|

9, 'A/364'

|

Actual/364

|

Return Type

float

Remarks

· If @Settlement IS NULL then @Settlement = GETDATE()

· If @Basis is NULL then @Basis = 0

· If @Basis is invalid then PRICEMAT returns an error

Example

This security issued on 2014-07-31 matures on 2014-12-15 with an interest rate of 0.5% and a yield of 0.2%. Interest is calculated using the Actual/365 day-count convention.

SELECT

wct.PRICEMAT(

'2014-10-07' --@Settlement

,'2014-12-15' --@Maturity

,'2014-07-31' --@Issue

,0.005 --@Rate

,0.002 --@Yield

,3 --@Basis

) as Price

This produces the following result.

Price

----------------------

100.056655689645

This security issued on 2014-08-15 matures on 2014-12-01 with an interest rate of -0.05% and a yield of 0.1%. Interest is calculated using the Actual/360 day-count convention.

SELECT

wct.PRICEMAT(

'2014-10-07' --@Settlement

,'2014-12-01' --@Maturity

,'2014-08-15' --@Issue

,-0.0005 --@Rate

,0.001 --@Yield

,2 --@Basis

) as Price

This produces the following result.

Price

----------------------

99.9770879583983

This security issued on 2014-08-10 matures on 2014-11-15 with a yield of -0.05% and an interest rate of 0.2%. Interest is calculated using the 30/E 360 (ISDA) day-count convention.

SELECT

wct.PRICEMAT(

'2014-10-07' --@Settlement

,'2014-11-15' --@Maturity

,'2014-08-10' --@Issue

,0.002 --@Rate

,-0.0005 --@Yield

,4 --@Basis

) as Price

This produces the following result.

Price

----------------------

100.026391953094

This security issued on 2014-07-01 matures on 2014-12-29 with an interest rate of 7.0% and a yield of 8.5%. Interest is calculated using the Actual/364 day-count convention.

SELECT

wct.PRICEMAT(

'2014-10-07' --@Settlement

,'2014-12-29' --@Maturity

,'2014-07-01' --@Issue

,0.07 --@Rate

,0.085 --@Yield

,9 --@Basis

) as Price

This produces the following result.

Price

----------------------

99.628637367672

See Also