PRICEDISC

Updated: 23 May 2016

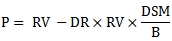

Use PRICEDISC to calculate the price per 100 face value for a discounted security. The PRICEDISC formula is:

Where:

|

B

|

=

|

Number of days in the year

|

|

DR

|

=

|

Discount Rate

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

RV

|

=

|

Redemption Value

|

Syntax

SELECT [westclintech].[wct].[PRICEDISC] (

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Discount, float,>

,<@Redemption, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date of the security. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the security. @Maturity is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Discount

the security’s discount rate. @Discount is an expression of type float or of a type that can be implicitly converted to float.

@Redemption

the security’s redemption value per 100 face value. @Redemption is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

@Basis

|

Day count basis

|

|

0, 'BOND'

|

US (NASD) 30/360

|

|

1, 'ACTUAL'

|

Actual/Actual

|

|

2, 'A360'

|

Actual/360

|

|

3, 'A365'

|

Actual/365

|

|

4, '30E/360 (ISDA)', '30E/360', 'ISDA', '30E/360 ISDA', 'EBOND'

|

European 30/360

|

|

5, '30/360', '30/360 ISDA', 'GERMAN'

|

30/360 ISDA

|

|

7, 'NL/365'

|

No Leap Year /365

|

|

8, 'NL/360'

|

No Leap Year /360

|

|

9, 'A/364'

|

Actual/364

|

|

21, 'Actual/ISDA'

|

Actual/ISDA

|

Return Type

float

Remarks

· If @Settlement IS NULL then @Settlement = GETDATE()

· If @Basis is NULL then @Basis = 0

· If @Basis is invalid then PRICEDISC returns an error

Examples

This is a security maturing on 2014-12-15 with a 100 redemption value and a discount rate of 1.5%. The discount rate is quoted using the Actual/365 day-count convention.

SELECT

wct.PRICEDISC(

'2014-10-07' --@Settlement

,'2014-12-15' --@Maturity

,0.015 --@Discount

,100 --@Redemption

,3 --@Basis

) as Price

This produces the following result.

This is a security maturing on 2015-02-15 with a 10000 redemption value and a discount rate of 1.9%. The discount rate is quoted using the Actual/360 day-count convention.

SELECT

wct.PRICEDISC(

'2014-10-07' --@Settlement

,'2015-02-15' --@Maturity

,0.019 --@Discount

,10000 --@Redemption

,2 --@Basis

) as Price

This produces the following result.

This is a security maturing on 2015-04-15 with a 1,000,000 redemption value and a discount rate of 5.5%. The discount rate is quoted using the Actual/364 day-count convention.

SELECT

wct.PRICEDISC(

'2014-10-07' --@Settlement

,'2015-04-15' --@Maturity

,0.055 --@Discount

,1000000 --@Redemption

,9 --@Basis

) as Price

This produces the following result.

See Also