COMPINT

Updated: 30 November 2013

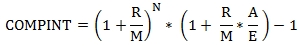

Use the scalar function COMPINT to calculate the accrued interest for a security where interest is compounded periodically and paid at maturity.

Where:

R = the coupon interest rate as a decimal

M = the number of compounding periods per year

N = the number of whole coupons prior to the settlement date

A = the number of accrued days in the coupon period in which the settlement occurs

E = the number of days as specified by the basis code for the coupon period in which the settlement occurs.

Syntax

SELECT [wctFinancial].[wct].[COMPINT](

<@Basis, nvarchar(4000),>

,<@Rate, float,>

,<@IssueDate, datetime,>

,<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@CompFreq, int,>)

Arguments

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

Basis

|

Day count basis

|

|

0

|

US (NASD) 30/360

|

|

1

|

Actual/Actual

|

|

2

|

Actual/360

|

|

3

|

Actual/365

|

|

4

|

European 30/360

|

@Rate

the coupon rate of the security expressed in decimal terms. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@IssueDate

the issue date of the security; the first interest accrual date. @IssueDate is an expression of a datetime data type or of a type that can be implicitly converted to datetime.

@Settlement

the settlement date occurring within a coupon period of the security; interest is accrued from @IssueDate through to @Settlement. @Settlement is an expression of a datetime data type or of a type that can be implicitly converted to datetime.

@Maturity

the maturity date of the bond. @Maturity is used to determine the coupon dates. @Maturity is an expression of a datetime data type or of a type that can be implicitly converted to datetime.

@CompFreq

the number of times the coupon is compounded annually. For annual compounding, @CompFreq = 1; for semi-annual, @CompFreq = 2; for quarterly, @CompFreq = 4, and for monthly, @CompFreq = 12. @CompFreq is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

· If @CompFreq not 1, 2, 4, or 12 an error will be returned.

· @Issuedate <= @Settlement <= @Maturity.

· For bonds with an odd first or an odd last coupon period (or both), use ODDCOMPINT.

· COMPINT returns a factor. To calculate the monetary value of the accrued interest, you should multiply this factor by the face amount of the bond.

Examples

A 3-year bond, compounding monthly, with settlement in the first coupon period. Interest is accrued on an actual/actual basis.

SELECT wct.COMPINT(

1 --@Basis

,.0175 --@Rate

,'2013-11-15' --@IssueDate

,'2013-11-29' --@Settelemt

,'2016-11-15' --@Maturity

,12 --@CompFreq

) as COMPINT

This produces the following result.

COMPINT

----------------------

0.000680555555555573

The same bond, settling 1 year later.

SELECT wct.COMPINT(

1 --@Basis

,.0175 --@Rate

,'2013-11-15' --@IssueDate

,'2014-11-29' --@Settelemt

,'2016-11-15' --@Maturity

,12 --@CompFreq

) as COMPINT

This produces the following result.

COMPINT

----------------------

0.0183336104248544

By entering the maturity date as the settlement date, we can calculate the total amount of the compound interest at maturity.

SELECT wct.COMPINT(

1 --@Basis

,.0175 --@Rate

,'2013-11-15' --@IssueDate

,'2016-11-15' --@Settelemt

,'2016-11-15' --@Maturity

,12 --@CompFreq

) as COMPINT

This produces the following result.

COMPINT

----------------------

0.0538622573229668

See Also