STEPDURATION

Updated: 21 April 2014

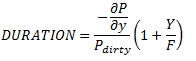

Use STEPDURATION to calculate the duration for a stepped-coupon bond. The duration is calculated as the first derivative of the price of the bond with respect to yield multiplied by -1 divided by the dirty price of the bond multiplied by 1 plus the yield divided by the frequency.

Syntax

SELECT [wctFinancial].[wct].[STEPDURATION](

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Yld, float,>

,<@Redemption, float,>

,<@Frequency, float,>

,<@Basis, nvarchar(4000),>

,<@Coupons, nvarchar(max),>)

Arguments

@Settlement

the settlement date occurring within a coupon period of the bond. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the bond. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Yld

the yield for the maturity date passed into the function. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Redemption

the redemption value of the bond assuming a 100 par value. @Redemption is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of coupon payments per year. For annual payments, @Frequency = 1; for semi-annual, @Frequency = 2; for quarterly, @Frequency = 4; for monthly @Frequency = 12. @Frequency is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

Basis

|

Day count basis

|

|

0 or omitted

|

US (NASD) 30/360

|

|

1

|

Actual/Actual

|

|

2

|

Actual/360

|

|

3

|

Actual/365

|

|

4

|

European 30/360

|

@Coupons

a SELECT statement, as a string, which identifies the coupon dates and rates to be used in the duration calculation. The coupon rate is assumed to be in effect from the associated coupon date to the next greater coupon date returned by the SELECT statement. The last rate is assumed to be in effect from the last date until the maturity date of the bond.

Return Type

float

Remarks

· If @Basis < 0 or @Basis > 4, STEPDURATION returns an error.

· If @Maturity < @Settlement 0 is returned.

· If @Settlement is NULL, @Settlement = GETDATE()

· If @Frequency is NULL, @Frequency = 2

· If @Basis is NULL, @Basis = 0.

· If @Coupons is empty or NULL then coupon rate is assumed to be zero.

· Accrued interest is calculated from the previous coupon date to the settlement date.

· Previous coupon date is calculated backwards from the maturity date. If the maturity date is the last day of the month, all the previous coupon dates are assumed to occur on the last day of the month.

· Previous coupon date <= @Settlement < next coupon date

Examples

In this example we calculate the duration for a bond maturing on 2019-01-15 with the following step-up schedule.

|

2010-01-15

|

5.0%

|

|

2013-01-15

|

5.5%

|

|

2016-01-15

|

6.0%

|

The settlement date is April 21, 2014, the yield is 4.0% and the redemption value is 100.

SELECT wct.STEPDURATION(

'2014-04-21', --@Settlement

'2019-01-15', --@Maturity

.04, --@Yld

100, --@Redemption

2, --@Frequency

0, --@Basis

'SELECT wct.CALCDATE(2010,1,15),0.05 UNION ALL

SELECT wct.CALCDATE(2013,1,15),0.055 UNION ALL

SELECT wct.CALCDATE(2016,1,15),0.06' --@Coupons

) as DURATION

This produces the following result

DURATION

----------------------

4.18487140205481

The SELECT statement in @Coupons can make reference to another table, as in the following example.

SELECT

*

INTO

#coups

FROM (

SELECT '2010-1-15',0.05 UNION ALL

SELECT '2013-1-15',0.055 UNION ALL

SELECT '2016-1,15',0.06

)n(coupdate, couprate)

SELECT wct.STEPDURATION(

'2014-04-21', --@Settlement

'2019-01-15', --@Maturity

.04, --@Yld

100, --@Redemption

2, --@Frequency

0, --@Basis

'SELECT *FROM #coups' --@Coupons

) as DURATION

This produces the following result.

DURATION

----------------------

4.18487140205481

In this example we have multiple securities with different step-up schedules and we only have the prices which need to be converted to yields for input into the duration calculation. For purposes of this example, the coupon schedules are stored in a temporary table, #coups.

SELECT

*

INTO

#coups

FROM (

SELECT 'ABC', '2010-01-15', 0.050 UNION ALL

SELECT 'ABC', '2013-01-15', 0.055 UNION ALL

SELECT 'ABC', '2016-01-15', 0.060 UNION ALL

SELECT 'GHI', '2031-07-22', 0.070 UNION ALL

SELECT 'GHI', '2026-07-22', 0.0675 UNION ALL

SELECT 'GHI', '2021-07-22', 0.0650 UNION ALL

SELECT 'GHI', '2016-07-22', 0.0625 UNION ALL

SELECT 'GHI', '2011-07-22', 0.0600 UNION ALL

SELECT 'XYZ', '2023-03-01', 0.0600 UNION ALL

SELECT 'XYZ', '2019-03-01', 0.0575 UNION ALL

SELECT 'XYZ', '2015-03-1', 0.0550 UNION ALL

SELECT 'XYZ', '2011-03-1', 0.0

)c(secid, coupdate, couprate)

SELECT

secid

,wct.STEPDURATION(

'2014-04-21',

n.maturity,

wct.YIELDSTEP(

'2014-04-21',

n.maturity,

n.price,

n.redemption,

n.frequency,

n.basis,

'SELECT

coupdate,

couprate

FROM

#coups

WHERE

secid = ' + '''' + n.secid + ''''

),

n.redemption,

n.frequency,

n.basis,

'SELECT

coupdate,

couprate

FROM

#coups

WHERE

secid = ' + '''' + n.secid + ''''

) as DURATION

FROM (

SELECT 'ABC', '2019-01-15', 103.670988, 100, 2, 0 UNION ALL

SELECT 'GHI', '2036-07-22', 120.467994, 103, 2, 1 UNION ALL

SELECT 'XYZ', '2027-03-01', 97.478325, 101, 1, 0

)n(secid, maturity, price, redemption, frequency, basis)

This produces the following result.

secid DURATION

----- ----------------------

ABC 4.17171497362109

GHI 13.1030222345025

XYZ 9.96086919797441

See Also