IAM

Updated: 10 October 2014

Use IAM to calculate the price or yield for a bond that pays interest at maturity and has a par value of 100. The formula for price is:

Where:

|

A

|

=

|

Number of days from issue date to settlement date

|

|

B

|

=

|

Number of days in the year

|

|

DIM

|

=

|

Number of days from issue date to maturity date

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

R

|

=

|

Annual interest rate in decimal terms

|

|

Y

|

=

|

Annual Yield

|

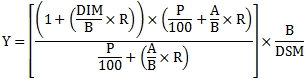

The formula for yield is:

Where:

|

A

|

=

|

Number of days from issue date to settlement date

|

|

B

|

=

|

Number of days in the year

|

|

DIM

|

=

|

Number of days from issue date to maturity date

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

R

|

=

|

Annual interest rate in decimal terms

|

|

Y

|

=

|

Annual Yield

|

The IAM function allows you to pass values for A, B, DIM, DSM, and R directly into the function and automatically calculates Y and P.

Syntax

SELECT [wctFinancial].[wct].[IAM](

<@A, float,>

,<@B, float,>

,<@D_IM, float,>

,<@DSM, float,>

,<@R, float,>

,<@P, float,>

,<@Y, float,>)

Arguments

@A

the number of days from issue to settlement. @A is an expression of type float or of a type that can be implicitly converted to float.

@B

the number days in the year. @DSC is an expression of type float or of a type that can be implicitly converted to float.

@D_IM

the number of days from issue to maturity. @D_IM is an expression of type float or of a type that can be implicitly converted to float.

@DSM

the number of days from settlement to maturity. @DSM is an expression of type float or of a type that can be implicitly converted to float.

@R

the annual interest rate. @R is an expression of type float or of a type that can be implicitly converted to float.

@P

the price of the security. @P is an expression of type float or of a type that can be implicitly converted to float.

@Y

the yield on the security. @Y is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

· If @A is NULL then @A = @D_IM - @DSM.

· If @B is NULL then @B =360.

· If @D_IM is NULL then @D_IM = 0.

· If @DSM is NULL then @DSM = 0.

· If @R is NULL then @R = 0.

· If @Y is NULL and @P is NULL then NULL is returned.

· If @Y is not NULL then the function calculates the price from the inputs otherwise the function calculates the yield.

Examples

In this example we calculate the price for a security with an interest rate of 0.5%. There are 68 accrued days, 137 days from issue to maturity, 69 days from settlement to maturity, and 365 days in the year. The yield is 0.2%

SELECT

wct.IAM(

68 --@A

,365 --@B

,137 --@D_IM

,69 --@DSM

,0.005 --@R

,NULL --@P

,0.002 --@Y

) as Price

This produce the following result.

Price

----------------------

100.056655689645

In this example we calculate the yield for a security with an interest rate -0.05%. There are 108 days from issue to maturity, 55 days from settlement to maturity, and 360 days in the year. The price is 99.977088.

SELECT

wct.IAM(

NULL --@A

,360 --@B

,108 --@D_IM

,55 --@DSM

,-0.0005 --@R

,99.977088 --@P

,NULL --@Y

) as Yield

This produces the following result.

Yield

----------------------

0.000999997275740647

In this example we calculate the price for a security with an interest rate of 0.2%. The yield is -0.05%. There are 95 days from issue to maturity, 38 days from settlement to maturity, and 360 days in the year.

SELECT

wct.IAM(

NULL --@A

,360 --@B

,95 --@D_IM

,38 --@DSM

,0.002 --@R

,NULL --@P

,-0.0005 --@Y

) as Price

This produces the following result.

Price

----------------------

100.026391953094

In this example we calculate the yield for a security with an interest rate 0.07%. There are 181 days from issue to maturity, 83 days from settlement to maturity, and 364 days in the year. The price is 99.628637.

SELECT

wct.IAM(

NULL --@A

,364 --@B

,181 --@D_IM

,83 --@DSM

,0.07 --@R

,99.628637 --@P

,NULL --@Y

) as Yield

This produces the following result.

Yield

----------------------

0.0850000161919074

See Also