Bullet

Updated: 18 September 2014

Use the table-valued function Bullet to return the cash flow schedule for a loan with a single payment of principal and interest at maturity. Only 2 rows are returned: one for the commencement of the loan and one for the maturity date of the loan.

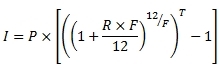

The interest payment is calculated as:

Where:

|

I

|

=

|

InterestPayment

|

|

P

|

=

|

@OutstandingAmount

|

|

R

|

=

|

@InterestRate

|

|

F

|

=

|

@Frequency

|

|

T

|

=

|

Time in years

|

Syntax

SELECT * FROM [wct].[Bullet](

<@OutstandingAmount, float,>

,<@InterestBasis, nvarchar(4000),>

,<@InterestRate, float,>

,<@Frequency, int,>

,<@MaturityDate, datetime,>

,<@ReferenceDate, datetime,>)

Arguments

@OutstandingAmount

the principal amount of the loan. @OutstandingAmount is an expression of type float or of a type that can be implicitly converted to float.

@InterestBasis

the day count convention used to calculate the interest amount. @InterestBasis can be 30/360, Actual/360, Actual/365, or Actual/Actual. @InterestBasis is an expression of the character string data type category.

@InterestRate

the annual rate of interest for the loan. @InterestRate is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of months in a regular interest payment. @Frequency is an expression of type int or of a type that can be implicitly converted to int.

@MaturityDate

the maturity date of the loan. @MaturityDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@ReferenceDate

the start date of the loan. @ReferenceDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

Return Type

RETURNS TABLE (

[Period] [int] NULL,

[PrincipalPayment] [float] NULL,

[InterestPayment] [float] NULL,

[CashFlow] [float] NULL,

[OutstandingExposure] [float] NULL,

[CapitalAmountInDebt] [float] NULL,

[TotalExposure] [float] NULL,

[NumberOfMonth] [int] NULL,

[PaymentDate] [datetime] NULL,

[GraceInterest] [float] NULL,

[InterestRate] [float] NULL

)

|

Column

|

Description

|

|

Period

|

A reference number uniquely identifying a row in the resultant table.

|

|

PrinicpalPayment

|

The amount of the principal payment.

|

|

InterestPayment

|

The amount of the interest payment.

|

|

CashFlow

|

The amount of the cash flow.

|

|

OutstandingExposure

|

When Period = 0, @OutstandingAmount. When Period = 1, @OutstandingAmount + InterestPayment.

|

|

CapitalAmountInDebt

|

When Period = 0, @OutstandingAmount. When Period = 1, 0

|

|

TotalExposure

|

See below.

|

|

NumberOfMonth

|

The number of months between the @ReferenceDate and the PaymentDate.

|

|

PaymentDate

|

The end-of-month date when the payment occurs.

|

|

GraceInterest

|

0

|

|

InterestRate

|

The interest rate from the @ReferenceDate to the @MaturityDate. See formula above.

|

Remarks

· The PaymentDate for all rows is generated as the last day of the month.

· For Period = 0, PrincipalPayment, InterestPayment, CashFlow, NumberOfMonth, GraceInterest, and InterestRate are set to 0.

· The time value (see formula above) is calculated using the day-count convention specified by @InterestBasis:

o For Actual/360 it is the number of days between the 2 PaymentDate values divided by 360 .

o For Actual/365 it is the number of days between the 2 PaymentDate values divided by 365.

o For Actual/Actual it is the number of days between the 2 PaymentDate values divided by the number of days in the year of the later PaymentDate.

o For 30/360 is the number of months between the 2 PaymentDate values divided by 12.

· If @InterestBasis is NULL then @InterestBasis = 30/360

· If @InterestBasis is not 30/360, ACTUAL/360, ACTUAL/365, or ACTUAL/ACTUAL then an error message will be generated.

· If @Frequency is NULL then @Frequency = 1

· If @InterestRate is NULL then @InterestRate = 0

· If @ReferenceDate is NULL then @ReferenceDate = GETDATE()

· If @MaturityDate is NULL then @MaturityDate = GETDATE()

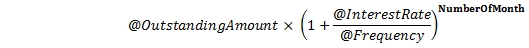

· TotalExposure is calculated as:

Examples

SELECT

*

FROM wct.Bullet(

6000000 --@OutstandingAmount

,'Actual/360' --@InterestBasis

,.07 --@InterestRate

,3 --@Frequency

,'2015-07-05' --@MaturityDate

,'2014-06-30' --@ReferenceDate

)

This produces the following result (which has been reformatted for ease of viewing).

|

Period

|

Principal

Payment

|

Interest

Payment

|

Cash

Flow

|

Outstanding

Exposure

|

Capital

Amount

In

Debt

|

Total

Exposure

|

Number

Of

Month

|

Payment

Date

|

Grace

Interest

|

Interest

Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

6000000.00

|

6000000.00

|

6000000.00

|

0

|

2014-06-30

|

0.00

|

0.000000

|

|

1

|

6000000.00

|

475938.10

|

6475938.10

|

6475938.10

|

0.00

|

6471270.64

|

13

|

2015-07-31

|

0.00

|

0.079323

|

See Also