RPIDURATION

Updated: 05 May 2014

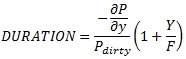

Use RPIDURATION to calculate the duration for a bond that pays regular periodic interest. The duration is calculated as the first derivative of the price of the bond with respect to yield multiplied by -1, divided by the dirty price of the bond multiplied by 1 plus the yield divided by the frequency.

Syntax

SELECT [wctFinancial].[wct].[RPICONVEXITY](

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Rate, float,>

,<@Yld, float,>

,<@Redemption, float,>

,<@Frequency, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date occurring within a coupon period of the bond. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the bond. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Rate

the bond’s annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yld

the yield for the maturity date passed into the function. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Redemption

the redemption value of the bond assuming a par value of 100. @Redemption is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of coupon payments per year. For annual payments, @Frequency = 1; for semi-annual, @Frequency = 2; for quarterly, @Frequency = 4; for bimonthly @Frequency = 6; for monthly, @Frequency = 12. For bonds with @Basis = 'A/364' or 9, you can enter 364 for payments made every 52 weeks, 182 for payments made every 26 weeks, 91 for payments made every 13 weeks, 28 for payments made every 4 weeks, 14 for payments made every 2 weeks, and 7 for weekly payments. @Frequency is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

@Basis

|

Day count basis

|

|

0, 'BOND'

|

US (NASD) 30/360

|

|

1, 'ACTUAL'

|

Actual/Actual

|

|

2, 'A360'

|

Actual/360

|

|

3, 'A365'

|

Actual/365

|

|

4, '30E/360 (ISDA)', '30E/360', 'ISDA', '30E/360 ISDA', 'EBOND'

|

European 30/360

|

|

5, '30/360', '30/360 ISDA', 'GERMAN'

|

30/360 ISDA

|

|

6, 'NL/ACT'

|

No Leap Year/ACT

|

|

7, 'NL/365'

|

No Leap Year /365

|

|

8, 'NL/360'

|

No Leap Year /360

|

|

9, 'A/364'

|

Actual/364

|

|

10, 'BOND NON-EOM'

|

US (NASD) 30/360 non-end-of-month

|

|

11, 'ACTUAL NON-EOM'

|

Actual/Actual non-end-of-month

|

|

12, 'A360 NON-EOM'

|

Actual/360 non-end-of-month

|

|

13, 'A365 NON-EOM'

|

Actual/365 non-end-of-month

|

|

14, '30E/360 NON-EOM', '30E/360 ICMA NON-EOM', 'EBOND NON-EOM'

|

European 30/360 non-end-of-month

|

|

15, '30/360 NON-EOM', '30/360 ISDA NON-EOM', 'GERMAN NON-EOM'

|

30/360 ISDA non-end-of-month

|

|

16, 'NL/ACT NON-EOM'

|

No Leap Year/ACT non-end-of-month

|

|

17, 'NL/365 NON-EOM'

|

No Leap Year/365 non-end-of-month

|

|

18, 'NL/360 NON-EOM'

|

No Leap Year/360 non-end-of-month

|

|

19, 'A/364 NON-EOM'

|

Actual/364 non-end-of-month

|

Return Type

float

Remarks

· If @Maturity <= @Settlement 0 is returned.

· If @Settlement is NULL, @Settlement = GETDATE()

· If @Rate is NULL, @Rate = 0

· If @Yld is NULL, @Yld = 0

· If @Frequency is NULL, @Frequency = 2

· If @Basis is NULL, @Basis = 0.

· If @Frequency is any number other than 1, 2, 4, 6 or 12, or for @Basis = 'A/364' any number other than 1, 2, 4, 6, or 12 as well as 7, 14, 28, 91, 182, or 364 RPIDURATION returns an error.

· If @Basis is invalid (see above list), RPIDURATION returns an error.

· @Rate is entered as a decimal value; 1.0% = 0.01

· @Yld is entered as a decimal value; 1.0% = 0.01

Examples

In this example we calculate the duration for a bond maturing on 2034-06-15. The settlement date is 2014-05-01, the yield is 2.76%, the coupon rate is 2.50%, the redemption value is 100, the coupon is paid twice-yearly, and the bais code is 1.

SELECT wct.RPIDURATION(

'2014-05-01', --@Settlement

'2034-06-15', --@Maturity

0.025, --@Rate

0.0276, --@Yield

100, --@Redemption

2, --@Frequency

1 --@Basis

) as DURATION

This produces the following result

DURATION

----------------------

15.6780086644317

In this example, we calculate the duration of a zero-coupon bond.

SELECT wct.RPIDURATION(

'2014-05-01', --@Settlement

'2044-06-15', --@Maturity

0.00, --@Rate

0.0301, --@Yield

100, --@Redemption

2, --@Frequency

1 --@Basis

) as DURATION

This produces the following result.

DURATION

----------------------

30.1236728174663

In this example we know the price of the bond (99.9875), but not the yield.

SELECT wct.RPIDURATION(

'2014-05-01', --@Settlement

'2024-09-15', --@Maturity

0.0190, --@Rate

wct.YIELD(

'2014-05-01',

'2024-09-15',

0.0190,

99.9875,

100,

2,

1

), --@Yield

100, --@Redemption

2, --@Frequency

1 --@Basis

) as DURATION

This produces the following result.

DURATION

----------------------

9.44057846789297

In this example we calculate the duration of a bond settling in the final coupon period.

SELECT wct.RPIDURATION(

'2014-05-01', --@Settlement

'2014-07-15', --@Maturity

0.0190, --@Rate

0.0005, --@Yield

100, --@Redemption

2, --@Frequency

0 --@Basis

) as DURATION

This produces the following result.

DURATION

----------------------

0.205585814877239

This is an example of a bond paying interest every 26 weeks.

SELECT wct.RPIDURATION(

'2014-10-01', --@Settlement

'2023-03-13', --@Maturity

0.1250, --@Rate

0.1100, --@Yield

100, --@Redemption

182, --@Frequency

9 --@Basis

) as DURATION

This produces the following result.

DURATION

----------------------

5.56584970656666

See Also