ODDFIPMT

Updated: 16 November 2014

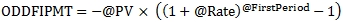

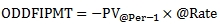

Use the scalar function ODDFIPMT to calculate the interest portion of a periodic payment for an annuity where the first period is either longer or shorter than the other periods. The interest for the first period is calculated as:

Else

Syntax

SELECT [wct].[ODDFIPMT](

<@Rate, float,>

,<@Per, int,>

,<@Nper, int,>

,<@PV, float,>

,<@FV, float,>

,<@FirstPeriod, float,>)

Arguments

@Rate

the periodic interest rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Per

the period of interest. @Per is an expression of type int or of a type that can be implicitly converted to int.

@Nper

the number of annuity payments. @Nper is an expression of type int or of a type that can be implicitly converted to int.

@PV

the present value of the annuity. @PV is an expression of type float or of a type that can be implicitly converted to float.

@FV

the future value as at the end of the annuity. @FV is an expression of type float or of a type that can be implicitly converted to float.

@FirstPeriod

the length of the first period. @FirstPeriod is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

· If @Rate <= -1 then NULL is returned.

· If @Nper < 1 then NULL is returned.

· If @FirstPeriod <= 0 then NULL is returned.

· If @Per < 1 Then NULL is returned.

· If @Per > @Nper Then NULL is returned.

· If @Nper is NULL then @Nper = 0.

· If @Rate is NULL then @Rate = 0.

· If @PV is NULL then @PV = 0.

· If @FV is NULL then @FV = 0.

· If @Per is NULL then @Per = 0.

· If @FirstPeriod is NULL then @FirstPeriod = 1.

· ODDFIPMT uses the same conventions for the sign of the inputs and the results as Excel and Google spreadsheets; generally @PV and @FV should have opposite signs and the ODDFPMT result will have the opposite sign of @PV.

Examples

Calculate the interest portion for the first period of an annuity assuming a periodic rate of 0.5%, with 36 periodic payments. The price of the annuity is 11,500 and there is no cash value at the end of the annuity. The first period is 1 and 5/6th longer than the other periods.

SELECT

wct.ODDFIPMT(

.005 --@Rate

,1 --@Per

,36 --@Nper

,-11500 --@PV

,0 --@FV

,1+5/6e+00 --@FirstPeriod

) as IPMT

This produces the following result.

IPMT

----------------------

105.636223805979

Using the same basic information in this SQL, we calculate the periodic interest for each of the first 10 payments.

SELECT

x.Per

,wct.ODDFIPMT(

.005 --@Rate

,x.Per --@Per

,36 --@Nper

,-11500 --@PV

,0 --@FV

,1+5/6e+00 --@FirstPeriod

) as IPMT

FROM (

VALUES (1),(2),(3),(4),(5),(6),(7),(8),(9),(10)

)x(Per)

This produces the following result.

Per IPMT

----------- ----------------------

1 105.636223805979

2 56.2716341574074

3 54.7964453665719

4 53.3138806317822

5 51.8239030733186

6 50.3264756270627

7 48.8215610435755

8 47.3091218871708

9 45.7891205349841

10 44.2615191760365

Calculate the interest portion of the first periodic payment for an annuity assuming a periodic rate of 0.5%, with 180 periodic payments. The price of the annuity is 250,000 and there is a 50,000 cash value at the end of the annuity. The first period is one-half as long as the other periods.

SELECT

wct.ODDFIPMT(

.005 --@Rate

,1 --@Per

,180 --@Nper

,-250000 --@PV

,50000 --@FV

,0.5 --@FirstPeriod

) as IPMT

This produces the following result.

IPMT

----------------------

624.220697042766

Using the same basic information in this SQL, we calculate the periodic interest for each of the last 10 payments.

SELECT

x.Per

,wct.ODDFIPMT(

.005 --@Rate

,x.Per --@Per

,180 --@Nper

,-250000 --@PV

,50000 --@FV

,0.5 --@FirstPeriod

) as IPMT

FROM (

VALUES (171),(172),(173),(174),(175),(176),(177),(178),(179),(180)

)x(Per)

This produces the following result.

Per IPMT

----------- ----------------------

171 331.855107050157

172 323.852086351572

173 315.809050549495

174 307.725799568407

175 299.602132332414

176 291.437846760241

177 283.232739760207

178 274.986607225173

179 266.699244027464

180 258.370444013766

Calculate the interest portion of the first weekly payment for an automobile lease with a term of 3 years and an annual interest rate of 25%. The amount to be financed is 11,000 and the residual value at the end of the lease is 3,500. The first payment is due 2014-11-25.

SELECT

wct.ODDFIPMT(

.25 * 7/365e+00 --@Rate

,1 --@Per

,156 --@Nper

,-11000 --@PV

,3500 --@FV

,DATEDIFF(d,'2014-11-13','2014-11-25')/7e+00 --@FirstPeriod

) as IPMT

This produces the following result.

IPMT

----------------------

90.5657016076089

Using the same basic information in this SQL, we calculate the periodic interest for each of the first 10 payments.

SELECT

x.Per

,wct.ODDFIPMT(

.25 * 7/365e+00 --@Rate

,x.Per --@Per

,156 --@Nper

,-11000 --@PV

,3500 --@FV

,DATEDIFF(d,'2014-11-13','2014-11-25')/7e+00 --@FirstPeriod

) as IPMT

FROM (

VALUES (1),(2),(3),(4),(5),(6),(7),(8),(9),(10)

)x(Per)

This produces the following result.

Per IPMT

----------- ----------------------

1 90.5657016076089

2 52.7639606027343

3 52.6069539540754

4 52.4491945338133

5 52.2906787327692

6 52.1314029244598

7 51.9713634650146

8 51.8105566930927

9 51.6489789297985

10 51.4866264785981

See Also