DIS

Updated: 10 October 2014

Use DIS to calculate the price or discount rate for a discount security. The formula for price is:

Where:

|

B

|

=

|

Number of days in the year

|

|

DR

|

=

|

Discount Rate

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

RV

|

=

|

Redemption Value

|

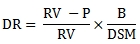

The formula for discount rate is:

Where:

|

B

|

=

|

Number of days in the year

|

|

DR

|

=

|

Discount Rate

|

|

DSM

|

=

|

Number of days from settlement date to maturity date

|

|

P

|

=

|

Price per 100 par value

|

|

RV

|

=

|

Redemption Value

|

The DIS function allows you to pass values for B/DSM, RV and either DR or P and returns the other.

Syntax

SELECT [wct].[DIS](

<@DSM, float,>

,<@RV, float,>

,<@P, float,>

,<@D, float,>)

Arguments

@DSM

the time in years from settlement to maturity. @DSM is an expression of type float or of a type that can be implicitly converted to float.

@RV

the redemption value. @RV is an expression of type float or of a type that can be implicitly converted to float.

@P

the price of the security. @P is an expression of type float or of a type that can be implicitly converted to float.

@D

the discount rate on the security. @D is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

· If @DSM is NULL then @DSM = 0.

· If @RV is NULL then @RV = 100.

· If @D is NULL and @P is NULL then NULL is returned.

· If @D is not NULL then the function calculates the price from the inputs otherwise the function calculates the discount rate.

Examples

In this example we calculate the discount rate for a security with a price of 99.72 and redemption value of 100. There are 69 days from settlement to maturity and 365 days in the year.

SELECT

wct.DIS(

69/365E+00 --@DSM

,100.00 --@RV

,99.72 --@P

,NULL --@D

) as [Discount Rate]

This produce the following result.

Discount Rate

----------------------

0.0148115942028987

In this example we calculate the price for a security with a discount rate of 1.9%. There are 131 days from settlement to maturity and 360 days in the year.

SELECT

wct.DIS(

131/360E+00--@DSM

,10000.00 --@RV

, NULL --@P

,0.019 --@D

) as [Price]

This produces the following result.

Price

----------------------

9930.86111111111

In this example we calculate the price for a security with a discount rate of 5.5%. There are 190 days from settlement to maturity and 364 days in the year.

SELECT

wct.DIS(

190/364E+00--@DSM

,1000000.00 --@RV

, NULL --@P

,0.055 --@D

) as [Price]

This produces the following result.

Price

----------------------

971291.208791209

See Also