OFCMDURATION

Updated: 31 May 2014

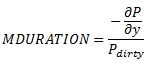

Use OFCMDURATION to calculate the modified duration for a bond that has an odd first coupon. Modified duration is calculated as the first derivative of the price with respect to yield multiplied by -1 divided by the dirty price of the bond.

Syntax

SELECT [wctFinancial].[wct].[OFCMDURATION](

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@IssueDate, datetime,>

,<@FirstCouponDate, datetime,>

,<@Rate, float,>

,<@Yld, float,>

,<@Redemption, float,>

,<@Frequency, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date of the security. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the security. @Maturity is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@IssueDate

the issue date of the security; the date from which the security starts accruing interest. @Issue is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@FirstCouponDate

the first coupon date of the security. The period from the issue date until the first coupon date defines the odd interest period. All subsequent coupon dates are assumed to occur at regular periodic intervals as defined by @Frequency. @FirstCouponDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Rate

the bond’s annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yld

the yield for the maturity date passed into the function. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Redemption

the redemption value of the bond assuming a par value of 100. @Redemption is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of coupon payments per year. For annual payments, @Frequency = 1; for semi-annual, @Frequency = 2; for quarterly, @Frequency = 4; for bimonthly @Frequency = 6; for monthly, @Frequency = 12. For bonds with @Basis = 'A/364' or 9, you can enter 364 for payments made every 52 weeks, 182 for payments made every 26 weeks, 91 for payments made every 13 weeks, 28 for payments made every 4 weeks, 14 for payments made every 2 weeks, and 7 for weekly payments. @Frequency is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

@Basis

|

Day count basis

|

|

0, 'BOND'

|

US (NASD) 30/360

|

|

1, 'ACTUAL'

|

Actual/Actual

|

|

2, 'A360'

|

Actual/360

|

|

3, 'A365'

|

Actual/365

|

|

4, '30E/360 (ISDA)', '30E/360', 'ISDA', '30E/360 ISDA', 'EBOND'

|

European 30/360

|

|

5, '30/360', '30/360 ISDA', 'GERMAN'

|

30/360 ISDA

|

|

6, 'NL/ACT'

|

No Leap Year/ACT

|

|

7, 'NL/365'

|

No Leap Year /365

|

|

8, 'NL/360'

|

No Leap Year /360

|

|

9, 'A/364'

|

Actual/364

|

|

10, 'BOND NON-EOM'

|

US (NASD) 30/360 non-end-of-month

|

|

11, 'ACTUAL NON-EOM'

|

Actual/Actual non-end-of-month

|

|

12, 'A360 NON-EOM'

|

Actual/360 non-end-of-month

|

|

13, 'A365 NON-EOM'

|

Actual/365 non-end-of-month

|

|

14, '30E/360 NON-EOM', '30E/360 ICMA NON-EOM', 'EBOND NON-EOM'

|

European 30/360 non-end-of-month

|

|

15, '30/360 NON-EOM', '30/360 ISDA NON-EOM', 'GERMAN NON-EOM'

|

30/360 ISDA non-end-of-month

|

|

16, 'NL/ACT NON-EOM'

|

No Leap Year/ACT non-end-of-month

|

|

17, 'NL/365 NON-EOM'

|

No Leap Year/365 non-end-of-month

|

|

18, 'NL/360 NON-EOM'

|

No Leap Year/360 non-end-of-month

|

|

19, 'A/364 NON-EOM'

|

Actual/364 non-end-of-month

|

Return Type

float

Remarks

· If @Maturity <= @Settlement 0 is returned.

· If @Settlement is NULL, @Settlement = GETDATE()

· If @Rate is NULL, @Rate = 0

· If @Yld is NULL, @Yld = 0

· If @Frequency is NULL, @Frequency = 2

· If @Basis is NULL, @Basis = 0.

· If @Frequency is any number other than 1, 2, 4, 6 or 12, or for @Basis = 'A/364' any number other than 1, 2, 4, 6, or 12 as well as 7, 14, 28, 91, 182, or 364 OFCMDURATION returns an error.

· If @Basis is invalid (see above list), OFCMDURATION returns an error.

· @Rate is entered as a decimal value; 1.0% = 0.01

· @Yld is entered as a decimal value; 1.0% = 0.01

· If @Maturity is NULL an error will be returned.

· If @IssueDate is NULL an error will be returned.

· If @FirstCouponDate is NULL an error will be returned.

Examples

This bond has an odd short first coupon (meaning that the first coupon period is shorter than a normal coupon period) and settles on the issue date.

SELECT

wct.OFCMDURATION(

'2014-05-01', --@Settlement

'2034-06-15', --@Maturity

'2014-05-01', --@Issue

'2014-06-15', --@FirstCoupon

0.025, --@Rate

0.0276, --@Yield

100, --@Redemption

2, --@Frequency

1 --@Basis

) as OFCMDURATION

This produces the following result

OFCMDURATION

----------------------

15.6144561116539

This bond has odd long first coupon (meaning that the first coupon period is longer than a normal coupon period) and settles on the issue date.

SELECT

wct.OFCMDURATION(

'2014-05-01', --@Settlement

'2034-06-15', --@Maturity

'2014-05-01', --@Issue

'2014-12-15', --@FirstCoupon

0.025, --@Rate

0.0276, --@Yield

100, --@Redemption

2, --@Frequency

1 --@Basis

) as OFCMDURATION

This produces the following result.

OFCMDURATION

----------------------

15.6166935665617

Here we calculate the duration of a bond with an odd short first coupon with semi-annual coupons payable on March 30th and September 30th.

SELECT

wct.OFCMDURATION(

'2014-03-15', --@Settlement

'2034-09-30', --@Maturity

'2014-03-01', --@Issue

'2014-03-30', --@FirstCoupon

0.0257, --@Rate

0.0269, --@Yield

100, --@Redemption

2, --@Frequency

11 --@Basis

) as OFCMDURATION

This produces the following result.

OFCMDURATION

----------------------

15.8063908698314

In this example we know the price of the bond (99.9875), but not the yield.

SELECT

wct.OFCMDURATION(

'2014-05-28', --@Settlement

'2034-11-30', --@Maturity

'2014-05-01', --@Issue

'2014-11-30', --@FirstCoupon

0.0225, --@Rate

wct.ODDFYIELD(

'2014-05-28',

'2034-11-30',

'2014-05-01',

'2014-11-30',

0.0225,

99.875,

100,

2,

5

), --@Yield

100, --@Redemption

2, --@Frequency

5 --@Basis

) as OFCMDURATION

This produces the following result.

OFCMDURATION

----------------------

16.3237586351727

This is an example of a bond paying interest every 26 weeks.

SELECT

wct.OFCMDURATION(

'2014-10-04', --@Settlement

'2029-12-12', --@Maturity

'2014-03-26', --@Issue

'2014-12-31', --@FirstCoupon

0.1250, --@Rate

0.1100, --@Yield

100, --@Redemption

182, --@Frequency

9 --@Basis

) as OFCMDURATION

This produces the following result.

OFCMDURATION

----------------------

6.75842817646022

See Also