DURATION

Updated: 10 July 2014

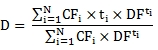

Use DURATION to calculate the Macaulay duration (in years) of a security with regular, periodic interest payments. DURATION assumes a redemption value of 100. The formula for DURATION is:

Where

|

D

|

=

|

Duration

|

|

CFi

|

=

|

ith future cash flow

|

|

ti

|

=

|

time, in coupon periods, to the ith cash flow

|

|

DF

|

=

|

(1 + @Yld/@Frequency)

|

|

N

|

=

|

Number of coupon payments from settlement to maturity

|

Syntax

SELECT [westclintech].[wct].[DURATION] (

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Rate, float,>

,<@Yld, float,>

,<@Frequency, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date of the security. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the security. @Maturity is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Rate

the security’s annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yld

the security’s annual yield. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of coupon payments per year. For annual payments, @Frequency = 1; for semi-annual, @Frequency = 2; for quarterly, @Frequency = 4; for bi-monthly @Frequency = 6; for monthly @Frequency =12. @Frequency is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

|

@Basis

|

Day count basis

|

|

0, 'BOND'

|

US (NASD) 30/360

|

|

1, 'ACTUAL'

|

Actual/Actual

|

|

2, 'A360'

|

Actual/360

|

|

3, 'A365'

|

Actual/365

|

|

4, '30E/360 (ISDA)', '30E/360', 'ISDA', '30E/360 ISDA', 'EBOND'

|

European 30/360

|

|

5, '30/360', '30/360 ISDA', 'GERMAN'

|

30/360 ISDA

|

|

6, 'NL/ACT'

|

No Leap Year/ACT

|

|

7, 'NL/365'

|

No Leap Year /365

|

|

8, 'NL/360'

|

No Leap Year /360

|

|

9, 'A/364'

|

Actual/364

|

|

10, 'BOND NON-EOM'

|

US (NASD) 30/360 non-end-of-month

|

|

11, 'ACTUAL NON-EOM'

|

Actual/Actual non-end-of-month

|

|

12, 'A360 NON-EOM'

|

Actual/360 non-end-of-month

|

|

13, 'A365 NON-EOM'

|

Actual/365 non-end-of-month

|

|

14, '30E/360 NON-EOM', '30E/360 ICMA NON-EOM', 'EBOND NON-EOM'

|

European 30/360 non-end-of-month

|

|

15, '30/360 NON-EOM', '30/360 ISDA NON-EOM', 'GERMAN NON-EOM'

|

30/360 ISDA non-end-of-month

|

|

16, 'NL/ACT NON-EOM'

|

No Leap Year/ACT non-end-of-month

|

|

17, 'NL/365 NON-EOM'

|

No Leap Year/365 non-end-of-month

|

|

18, 'NL/360 NON-EOM'

|

No Leap Year/360 non-end-of-month

|

|

19, 'A/364 NON-EOM'

|

Actual/364 non-end-of-month

|

Return Type

float

Remarks

· If @Frequency is any number other than 1, 2, 4, 6 or 12 DURATION returns an error.

· If @Basis is invalid (see above list), DURATION returns an error.

Example

This bond has a coupon rate of 3.0%, pays interest semi-annually on the 30th of November and the 31st of May and matures on 2033-11-30. The settlement date for the transaction is 2014-10-10 and the yield is 3.15%. The bond is quoted using the Actual/Actual day-count convention.

SELECT

wct.DURATION(

'2014-10-10' --@Settlement

,'2033-11-30' --@Maturity

,0.03 --@Rate

,0.0315 --@Yld

,2 --@Frequency

,1 --@Basis

) AS DURATION

This produces the following result.

DURATION

----------------------

14.4816608104738

This bond has a 2.80% coupon rate, pays interest semi-annually on the 30th of September and the 30th of March and matures on 2044-09-30. The price of the bond is 99.375 and the date of the transaction is 2014-10-10. The bond is quoted using the US 30/360 day-count convention.

SELECT

wct.DURATION(

'2014-10-10' --@Settlement

,'2044-09-30' --@Maturity

,0.028 --@Coupon

,wct.YIELD(

'2014-10-10' --@Settlement

,'2044-09-30' --@Maturity

,0.028 --@Coupon

,99.375 --@Price

,100 --@Redemption

,2 --@Frequency

,1 --@Basis

) --@Yield

,2 --@Frequency

,10 --@Basis

) AS DURATION

This produces the following result.

DURATION

----------------------

20.4272373512074

See Also