Balloon

Updated: 18 September 2014

Use the table-valued function Balloon to return the cash flow schedule for a loan with periodic payments of interest (only) and with the principal paid at maturity.

The interest payment period is entered in Balloon as the number of months between interest payments. For example, a loan with monthly interest payments would have a frequency of 1. A loan with quarterly interest payments would have frequency of 3. A loan with annual principal payments would have a frequency of 12.

Balloon supports both an initial grace period and an additional grace period during the life of the loan. All payments and their associated dates are calculated with respect to a reference date supplied to the function (which should not be confused with the start date). If an initial grace period is entered in Balloon and it is greater than the reference date, then it becomes the first interest payment date and subsequent interest payments are calculated from that date forward.

If any payments would otherwise occur in the specified grace period, then that payment is moved to the end of the grace period and all remaining payments are calculated from the end of the grace period.

If no initial grace period is specified then the first payment date is calculated using the interest payment frequency. If the start date has been entered and the number of months between the start date and the reference date is less than the frequency, then the first payment date is calculated by adding the frequency (as a number of months) to the start date.

If no start date has been entered but a previous payment date has been entered and the number of months between the previous payment date and the reference date is less than the frequency, then the first payment date is calculated by adding the frequency (as a number of months) to the previous payment date.

If there is not start date and previous payment dates or the number of months between those dates and the reference date is greater than the frequency, then the first payment date is calculated by adding the frequency (as a number of months) to the reference date.

All payments in the resultant table are moved to the end of the month and interest is calculated using these end-of-month dates.

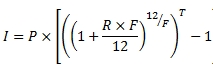

The interest payment is calculated as:

Where:

|

I

|

=

|

InterestPayment

|

|

P

|

=

|

@OutstandingAmount

|

|

R

|

=

|

@InterestRate

|

|

F

|

=

|

@Frequency

|

|

T

|

=

|

Time, in years, from PaymentDate(Period -1) to PaymentDate

|

If an interest payment occurs at the end of the initial grace period or at the end of the interim grace period and the length of the period (in months) if greater than the frequency, then Balloon calculates a 'grace' interest amount and a regular periodic interest amount.

Syntax

SELECT * FROM [wct].[Balloon](

<@OutstandingAmount, float,>

,<@InterestBasis, nvarchar(4000),>

,<@InterestRate, float,>

,<@PaymentFrequency, int,>

,<@MaturityDate, datetime,>

,<@ReferenceDate, datetime,>

,<@PrevPayDate, datetime,>

,<@StartDate, datetime,>

,<@FirstPayDate, datetime,>

,<@GracePeriodStartDate, datetime,>

,<@GracePeriodEndDate, datetime,>)

Arguments

@OutstandingAmount

the principal amount of the loan. @OutstandingAmount is an expression of type float or of a type that can be implicitly converted to float.

@InterestBasis

the day count convention used to calculate the interest amount. @InterestBasis can be 30/360, Actual/360, Actual/365, or Actual/Actual. @InterestBasis is an expression of the character string data type category.

@InterestRate

the annual rate of interest for the loan. @InterestRate is an expression of type float or of a type that can be implicitly converted to float.

@PaymentFrequency

the number of months in a regular interest payment. @PaymentFrequency is an expression of type int or of a type that can be implicitly converted to int.

@MaturityDate

the maturity date of the loan. @MaturityDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@ReferenceDate

the starting date for the number of months with respect to all other dates. @ReferenceDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@PrevPayDate

the last interest payment date prior to the reference date. @PrevPayDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@StartDate

the start date of the loan. @StartDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@FirstPayDate

the first payment date of the loan if other than a regular periodic payment. @FirstPayDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@GracePeriodStartDate

the date on which the (interim) grace period commences. @GracePeriodStratDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@GracePeriodEndDate

the date on which the (interim) grace period concludes. @GracePeriodEndDate is an expression that returns a datetime or smalldatetime value, or a character string in date format.

Return Type

RETURNS TABLE (

[Period] [int] NULL,

[PrincipalPayment] [float] NULL,

[InterestPayment] [float] NULL,

[CashFlow] [float] NULL,

[OutstandingExposure] [float] NULL,

[CapitalAmountInDebt] [float] NULL,

[TotalExposure] [float] NULL,

[NumberOfMonth] [int] NULL,

[PaymentDate] [datetime] NULL,

[GraceInterest] [float] NULL,

[InterestRate] [float] NULL

)

|

Column

|

Description

|

|

Period

|

A reference number uniquely identifying a row in the resultant table.

|

|

PrinicpalPayment

|

The amount of the principal payment. The only principal payment is on the maturity date of the loan.

|

|

InterestPayment

|

The amount of the regular interest payment.

|

|

CashFlow

|

PrincipalPayment + InterestPayment + GraceInterest.

|

|

OutstandingExposure

|

When Period = 0 then @OutstandingAmount. For Period > 0 then OutstandingExposure(Period-1) + InterestPayment.

|

|

CapitalAmountInDebt

|

When Period = 0, @OutstandingAmount. For Period > 0 then CapitalAmountinDebt(Period-1) - PrincipalPayment

|

|

TotalExposure

|

When Period = 0, @OutstandingAmount. For Period > 0 then CapitalAmountinDebt(Period-1) + InterestPayment

|

|

NumberOfMonth

|

The number of months between the @ReferenceDate and the PaymentDate.

|

|

PaymentDate

|

The end-of-month date of the payment.

|

|

GraceInterest

|

The amount of the grace interest

|

|

InterestRate

|

The interest rate from the @ReferenceDate to the @MaturityDate. See formula above.

|

Remarks

· The PaymentDate for all rows is generated as the last day of the month.

· For Period = 0, PrincipalPayment, InterestPayment, CashFlow, NumberOfMonth, GraceInterest, and InterestRate are set to 0.

· The time value (see formula above) is calculated based on @InterestBasis:

o For Actual/360 it is the number of days between the 2 PaymentDate values divided by 360 .

o For Actual/365 it is the number of days between the 2 PaymentDate values divided by 365.

o For Actual/Actual it is the number of days between the 2 PaymentDate values divided by the number of days in the year of the later PaymentDate.

o For 30/360 is the number of months between the 2 PaymentDate values divided by 12.

· If @InterestBasis is NULL then @InterestBasis = 30/360

· If @InterestBasis is not 30/360, ACTUAL/360, ACTUAL/365, or ACTUAL/ACTUAL then an error message will be generated.

· If @Frequency is NULL then @Frequency = 1

· If @InterestRate is NULL then @InterestRate = 0

· If @ReferenceDate is NULL then @ReferenceDate = GETDATE()

· If @MaturityDate is NULL then @MaturityDate = GETDATE()

· GraceInterest is only calculated on @FirstPayDate and @GracePeriodEndDate.

· GraceInterest is only calculated if NumberOfMonth – NumberOfMonth(Period-1) > @PaymentFrequency

· GraceInterest is the difference between the interest for the period from the previous row to the current row minus interest that would have been calculated for a period with length equal to @PaymentFrequency

· The last row returned will always be for the maturity date and may be shorter than a regular period depending on the combination of dates and @PaymentFrequency

Examples

This is a simple 5-year loan with quarterly payments of interest.

SELECT

*

FROM wct.Balloon(

100000 --@OutstandingAmount

,'Actual/365' --@InterestBasis

,.04 --@InterestRate

,3 --@PaymentFrequency

,'2019-09-15' --@MaturityDate

,'2014-09-15' --@ReferenceDate

,NULL --@PrevPayDate

,NULL --@StartDate

,NULL --@FirstPayDate

,NULL --@GracePeriodStartDate

,NULL --@GracePeriodEndDate

)

This produces the following result (which has been reformatted for ease of viewing).

|

Period

|

Principal Payment

|

Interest Payment

|

Cash Flow

|

Outstanding Exposure

|

Capital Amount In Debt

|

Total Exposure

|

Number Of Month

|

Payment Date

|

Grace Interest

|

Interest Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

100000.00

|

100000.00

|

100000.00

|

0

|

2014-09-30

|

0.00

|

0.000000

|

|

1

|

0.00

|

1008.26

|

1008.26

|

101008.26

|

100000.00

|

101008.26

|

3

|

2014-12-31

|

0.00

|

0.010083

|

|

2

|

0.00

|

986.23

|

986.23

|

101994.49

|

100000.00

|

100986.23

|

6

|

2015-03-31

|

0.00

|

0.009862

|

|

3

|

0.00

|

997.25

|

997.25

|

102991.74

|

100000.00

|

100997.25

|

9

|

2015-06-30

|

0.00

|

0.009972

|

|

4

|

0.00

|

1008.26

|

1008.26

|

104000.00

|

100000.00

|

101008.26

|

12

|

2015-09-30

|

0.00

|

0.010083

|

|

5

|

0.00

|

1008.26

|

1008.26

|

105008.26

|

100000.00

|

101008.26

|

15

|

2015-12-31

|

0.00

|

0.010083

|

|

6

|

0.00

|

997.25

|

997.25

|

106005.51

|

100000.00

|

100997.25

|

18

|

2016-03-31

|

0.00

|

0.009972

|

|

7

|

0.00

|

997.25

|

997.25

|

107002.76

|

100000.00

|

100997.25

|

21

|

2016-06-30

|

0.00

|

0.009972

|

|

8

|

0.00

|

1008.26

|

1008.26

|

108011.02

|

100000.00

|

101008.26

|

24

|

2016-09-30

|

0.00

|

0.010083

|

|

9

|

0.00

|

1008.26

|

1008.26

|

109019.28

|

100000.00

|

101008.26

|

27

|

2016-12-31

|

0.00

|

0.010083

|

|

10

|

0.00

|

986.23

|

986.23

|

110005.51

|

100000.00

|

100986.23

|

30

|

2017-03-31

|

0.00

|

0.009862

|

|

11

|

0.00

|

997.25

|

997.25

|

111002.76

|

100000.00

|

100997.25

|

33

|

2017-06-30

|

0.00

|

0.009972

|

|

12

|

0.00

|

1008.26

|

1008.26

|

112011.02

|

100000.00

|

101008.26

|

36

|

2017-09-30

|

0.00

|

0.010083

|

|

13

|

0.00

|

1008.26

|

1008.26

|

113019.28

|

100000.00

|

101008.26

|

39

|

2017-12-31

|

0.00

|

0.010083

|

|

14

|

0.00

|

986.23

|

986.23

|

114005.51

|

100000.00

|

100986.23

|

42

|

2018-03-31

|

0.00

|

0.009862

|

|

15

|

0.00

|

997.25

|

997.25

|

115002.76

|

100000.00

|

100997.25

|

45

|

2018-06-30

|

0.00

|

0.009972

|

|

16

|

0.00

|

1008.26

|

1008.26

|

116011.02

|

100000.00

|

101008.26

|

48

|

2018-09-30

|

0.00

|

0.010083

|

|

17

|

0.00

|

1008.26

|

1008.26

|

117019.28

|

100000.00

|

101008.26

|

51

|

2018-12-31

|

0.00

|

0.010083

|

|

18

|

0.00

|

986.23

|

986.23

|

118005.51

|

100000.00

|

100986.23

|

54

|

2019-03-31

|

0.00

|

0.009862

|

|

19

|

0.00

|

997.25

|

997.25

|

119002.76

|

100000.00

|

100997.25

|

57

|

2019-06-30

|

0.00

|

0.009972

|

|

20

|

100000.00

|

1008.26

|

101008.26

|

120011.02

|

0.00

|

101008.26

|

60

|

2019-09-30

|

0.00

|

0.010083

|

In this example, we modify the SQL by adding a first payment date so that the interest will not be paid until 31-Mar-2015.

SELECT

*

FROM wct.Balloon(

100000 --@OutstandingAmount

,'Actual/365' --@InterestBasis

,.4 --@InterestRate

,3 --@PaymentFrequency

,'2019-09-15' --@MaturityDate

,'2014-09-15' --@ReferenceDate

,NULL --@PrevPayDate

,NULL --@StartDate

,'2015-03-15' --@FirstPayDate

,NULL --@GracePeriodStartDate

,NULL --@GracePeriodEndDate

)

This produces the following result.

|

Period

|

Principal Payment

|

Interest Payment

|

Cash Flow

|

Outstanding Exposure

|

Capital Amount In Debt

|

Total Exposure

|

Number Of Month

|

Payment Date

|

Grace Interest

|

Interest Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

100000.00

|

100000.00

|

100000.00

|

0

|

2014-09-30

|

0.00

|

0.000000

|

|

1

|

0.00

|

986.23

|

2004.44

|

100986.23

|

100000.00

|

100986.23

|

6

|

2015-03-31

|

1018.20

|

0.020044

|

|

2

|

0.00

|

997.25

|

997.25

|

101983.48

|

100000.00

|

100997.25

|

9

|

2015-06-30

|

0.00

|

0.009972

|

|

3

|

0.00

|

1008.26

|

1008.26

|

102991.74

|

100000.00

|

101008.26

|

12

|

2015-09-30

|

0.00

|

0.010083

|

|

4

|

0.00

|

1008.26

|

1008.26

|

104000.00

|

100000.00

|

101008.26

|

15

|

2015-12-31

|

0.00

|

0.010083

|

|

5

|

0.00

|

997.25

|

997.25

|

104997.25

|

100000.00

|

100997.25

|

18

|

2016-03-31

|

0.00

|

0.009972

|

|

6

|

0.00

|

997.25

|

997.25

|

105994.49

|

100000.00

|

100997.25

|

21

|

2016-06-30

|

0.00

|

0.009972

|

|

7

|

0.00

|

1008.26

|

1008.26

|

107002.76

|

100000.00

|

101008.26

|

24

|

2016-09-30

|

0.00

|

0.010083

|

|

8

|

0.00

|

1008.26

|

1008.26

|

108011.02

|

100000.00

|

101008.26

|

27

|

2016-12-31

|

0.00

|

0.010083

|

|

9

|

0.00

|

986.23

|

986.23

|

108997.25

|

100000.00

|

100986.23

|

30

|

2017-03-31

|

0.00

|

0.009862

|

|

10

|

0.00

|

997.25

|

997.25

|

109994.50

|

100000.00

|

100997.25

|

33

|

2017-06-30

|

0.00

|

0.009972

|

|

11

|

0.00

|

1008.26

|

1008.26

|

111002.76

|

100000.00

|

101008.26

|

36

|

2017-09-30

|

0.00

|

0.010083

|

|

12

|

0.00

|

1008.26

|

1008.26

|

112011.02

|

100000.00

|

101008.26

|

39

|

2017-12-31

|

0.00

|

0.010083

|

|

13

|

0.00

|

986.23

|

986.23

|

112997.25

|

100000.00

|

100986.23

|

42

|

2018-03-31

|

0.00

|

0.009862

|

|

14

|

0.00

|

997.25

|

997.25

|

113994.50

|

100000.00

|

100997.25

|

45

|

2018-06-30

|

0.00

|

0.009972

|

|

15

|

0.00

|

1008.26

|

1008.26

|

115002.76

|

100000.00

|

101008.26

|

48

|

2018-09-30

|

0.00

|

0.010083

|

|

16

|

0.00

|

1008.26

|

1008.26

|

116011.02

|

100000.00

|

101008.26

|

51

|

2018-12-31

|

0.00

|

0.010083

|

|

17

|

0.00

|

986.23

|

986.23

|

116997.25

|

100000.00

|

100986.23

|

54

|

2019-03-31

|

0.00

|

0.009862

|

|

18

|

0.00

|

997.25

|

997.25

|

117994.50

|

100000.00

|

100997.25

|

57

|

2019-06-30

|

0.00

|

0.009972

|

|

19

|

100000.00

|

1008.26

|

101008.26

|

119002.76

|

0.00

|

101008.26

|

60

|

2019-09-30

|

0.00

|

0.010083

|

We modify the SQL so that there are no interest payments in 2018.

SELECT

*

FROM wct.Balloon(

100000 --@OutstandingAmount

,'Actual/365' --@InterestBasis

,.04 --@InterestRate

,3 --@PaymentFrequency

,'2019-09-15' --@MaturityDate

,'2014-09-15' --@ReferenceDate

,NULL --@PrevPayDate

,NULL --@StartDate

,'2015-03-15' --@FirstPayDate

,'2018-01-01' --@GracePeriodStartDate

,'2019-01-01' --@GracePeriodEndDate

)

This produces the following result.

|

Period

|

Principal Payment

|

Interest Payment

|

Cash Flow

|

Outstanding Exposure

|

Capital Amount In Debt

|

Total Exposure

|

Number Of Month

|

Payment Date

|

Grace Interest

|

Interest Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

100000.00

|

100000.00

|

100000.00

|

0

|

2014-09-30

|

0.00

|

0.000000

|

|

1

|

0.00

|

986.23

|

2004.44

|

100986.23

|

100000.00

|

100986.23

|

6

|

2015-03-31

|

1018.20

|

0.020044

|

|

2

|

0.00

|

997.25

|

997.25

|

101983.48

|

100000.00

|

100997.25

|

9

|

2015-06-30

|

0.00

|

0.009972

|

|

3

|

0.00

|

1008.26

|

1008.26

|

102991.74

|

100000.00

|

101008.26

|

12

|

2015-09-30

|

0.00

|

0.010083

|

|

4

|

0.00

|

1008.26

|

1008.26

|

104000.00

|

100000.00

|

101008.26

|

15

|

2015-12-31

|

0.00

|

0.010083

|

|

5

|

0.00

|

997.25

|

997.25

|

104997.25

|

100000.00

|

100997.25

|

18

|

2016-03-31

|

0.00

|

0.009972

|

|

6

|

0.00

|

997.25

|

997.25

|

105994.49

|

100000.00

|

100997.25

|

21

|

2016-06-30

|

0.00

|

0.009972

|

|

7

|

0.00

|

1008.26

|

1008.26

|

107002.76

|

100000.00

|

101008.26

|

24

|

2016-09-30

|

0.00

|

0.010083

|

|

8

|

0.00

|

1008.26

|

1008.26

|

108011.02

|

100000.00

|

101008.26

|

27

|

2016-12-31

|

0.00

|

0.010083

|

|

9

|

0.00

|

986.23

|

986.23

|

108997.25

|

100000.00

|

100986.23

|

30

|

2017-03-31

|

0.00

|

0.009862

|

|

10

|

0.00

|

997.25

|

997.25

|

109994.50

|

100000.00

|

100997.25

|

33

|

2017-06-30

|

0.00

|

0.009972

|

|

11

|

0.00

|

1008.26

|

1008.26

|

111002.76

|

100000.00

|

101008.26

|

36

|

2017-09-30

|

0.00

|

0.010083

|

|

12

|

0.00

|

1008.26

|

1008.26

|

112011.02

|

100000.00

|

101008.26

|

39

|

2017-12-31

|

0.00

|

0.010083

|

|

13

|

0.00

|

1008.26

|

4412.76

|

113019.28

|

100000.00

|

101008.26

|

52

|

2019-01-31

|

3404.50

|

0.044128

|

|

14

|

0.00

|

975.22

|

975.22

|

113994.50

|

100000.00

|

100975.22

|

55

|

2019-04-30

|

0.00

|

0.009752

|

|

15

|

0.00

|

1008.26

|

1008.26

|

115002.76

|

100000.00

|

101008.26

|

58

|

2019-07-31

|

0.00

|

0.010083

|

|

16

|

100000.00

|

667.39

|

100667.39

|

115670.15

|

0.00

|

100667.39

|

60

|

2019-09-30

|

0.00

|

0.006674

|

In this example we modify the SQL to get rid of the first payment date and calculate the first interest payment using the previous payment date.

SELECT

*

FROM wct.Balloon(

100000 --@OutstandingAmount

,'Actual/365' --@InterestBasis

,.04 --@InterestRate

,3 --@PaymentFrequency

,'2019-09-15' --@MaturityDate

,'2014-09-15' --@ReferenceDate

,'2014-08-15' --@PrevPayDate

,NULL --@StartDate

,NULL --@FirstPayDate

,'2018-01-01' --@GracePeriodStartDate

,'2019-01-01' --@GracePeriodEndDate

)

This produces the following result.

|

Period

|

Principal Payment

|

Interest Payment

|

Cash Flow

|

Outstanding Exposure

|

Capital Amount In Debt

|

Total Exposure

|

Number Of Month

|

Payment Date

|

Grace Interest

|

Interest Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

100000.00

|

100000.00

|

100000.00

|

0

|

2014-09-30

|

0.00

|

0.000000

|

|

1

|

0.00

|

667.39

|

667.39

|

100667.39

|

100000.00

|

100667.39

|

2

|

2014-11-30

|

0.00

|

0.006674

|

|

2

|

0.00

|

986.23

|

986.23

|

101653.62

|

100000.00

|

100986.23

|

5

|

2015-02-28

|

0.00

|

0.009862

|

|

3

|

0.00

|

1008.26

|

1008.26

|

102661.88

|

100000.00

|

101008.26

|

8

|

2015-05-31

|

0.00

|

0.010083

|

|

4

|

0.00

|

1008.26

|

1008.26

|

103670.14

|

100000.00

|

101008.26

|

11

|

2015-08-31

|

0.00

|

0.010083

|

|

5

|

0.00

|

997.25

|

997.25

|

104667.39

|

100000.00

|

100997.25

|

14

|

2015-11-30

|

0.00

|

0.009972

|

|

6

|

0.00

|

997.25

|

997.25

|

105664.64

|

100000.00

|

100997.25

|

17

|

2016-02-29

|

0.00

|

0.009972

|

|

7

|

0.00

|

1008.26

|

1008.26

|

106672.90

|

100000.00

|

101008.26

|

20

|

2016-05-31

|

0.00

|

0.010083

|

|

8

|

0.00

|

1008.26

|

1008.26

|

107681.16

|

100000.00

|

101008.26

|

23

|

2016-08-31

|

0.00

|

0.010083

|

|

9

|

0.00

|

997.25

|

997.25

|

108678.41

|

100000.00

|

100997.25

|

26

|

2016-11-30

|

0.00

|

0.009972

|

|

10

|

0.00

|

986.23

|

986.23

|

109664.64

|

100000.00

|

100986.23

|

29

|

2017-02-28

|

0.00

|

0.009862

|

|

11

|

0.00

|

1008.26

|

1008.26

|

110672.90

|

100000.00

|

101008.26

|

32

|

2017-05-31

|

0.00

|

0.010083

|

|

12

|

0.00

|

1008.26

|

1008.26

|

111681.16

|

100000.00

|

101008.26

|

35

|

2017-08-31

|

0.00

|

0.010083

|

|

13

|

0.00

|

997.25

|

997.25

|

112678.41

|

100000.00

|

100997.25

|

38

|

2017-11-30

|

0.00

|

0.009972

|

|

14

|

0.00

|

1008.26

|

4766.31

|

113686.67

|

100000.00

|

101008.26

|

52

|

2019-01-31

|

3758.05

|

0.047663

|

|

15

|

0.00

|

975.22

|

975.22

|

114661.89

|

100000.00

|

100975.22

|

55

|

2019-04-30

|

0.00

|

0.009752

|

|

16

|

0.00

|

1008.26

|

1008.26

|

115670.15

|

100000.00

|

101008.26

|

58

|

2019-07-31

|

0.00

|

0.010083

|

|

17

|

100000.00

|

667.39

|

100667.39

|

116337.54

|

0.00

|

100667.39

|

60

|

2019-09-30

|

0.00

|

0.006674

|

In this example we modify the SQL to eliminate the grace period and the previous payment date and add a start date.

SELECT

*

FROM wct.Balloon(

100000 --@OutstandingAmount

,'Actual/365' --@InterestBasis

,.04 --@InterestRate

,3 --@PaymentFrequency

,'2019-09-15' --@MaturityDate

,'2014-09-15' --@ReferenceDate

,NULL --@PrevPayDate

,'2011-09-15' --@StartDate

,NULL --@FirstPayDate

,NULL --@GracePeriodStartDate

,NULL --@GracePeriodEndDate

)

This produces the following result.

|

Period

|

Principal Payment

|

Interest Payment

|

Cash Flow

|

Outstanding Exposure

|

Capital Amount In Debt

|

Total Exposure

|

Number Of Month

|

Payment Date

|

Grace Interest

|

Interest Rate

|

|

0

|

0.00

|

0.00

|

0.00

|

100000.00

|

100000.00

|

100000.00

|

0

|

2014-09-30

|

0.00

|

0.000000

|

|

1

|

0.00

|

1008.26

|

1008.26

|

101008.26

|

100000.00

|

101008.26

|

3

|

2014-12-31

|

0.00

|

0.010083

|

|

2

|

0.00

|

986.23

|

986.23

|

101994.49

|

100000.00

|

100986.23

|

6

|

2015-03-31

|

0.00

|

0.009862

|

|

3

|

0.00

|

997.25

|

997.25

|

102991.74

|

100000.00

|

100997.25

|

9

|

2015-06-30

|

0.00

|

0.009972

|

|

4

|

0.00

|

1008.26

|

1008.26

|

104000.00

|

100000.00

|

101008.26

|

12

|

2015-09-30

|

0.00

|

0.010083

|

|

5

|

0.00

|

1008.26

|

1008.26

|

105008.26

|

100000.00

|

101008.26

|

15

|

2015-12-31

|

0.00

|

0.010083

|

|

6

|

0.00

|

997.25

|

997.25

|

106005.51

|

100000.00

|

100997.25

|

18

|

2016-03-31

|

0.00

|

0.009972

|

|

7

|

0.00

|

997.25

|

997.25

|

107002.76

|

100000.00

|

100997.25

|

21

|

2016-06-30

|

0.00

|

0.009972

|

|

8

|

0.00

|

1008.26

|

1008.26

|

108011.02

|

100000.00

|

101008.26

|

24

|

2016-09-30

|

0.00

|

0.010083

|

|

9

|

0.00

|

1008.26

|

1008.26

|

109019.28

|

100000.00

|

101008.26

|

27

|

2016-12-31

|

0.00

|

0.010083

|

|

10

|

0.00

|

986.23

|

986.23

|

110005.51

|

100000.00

|

100986.23

|

30

|

2017-03-31

|

0.00

|

0.009862

|

|

11

|

0.00

|

997.25

|

997.25

|

111002.76

|

100000.00

|

100997.25

|

33

|

2017-06-30

|

0.00

|

0.009972

|

|

12

|

0.00

|

1008.26

|

1008.26

|

112011.02

|

100000.00

|

101008.26

|

36

|

2017-09-30

|

0.00

|

0.010083

|

|

13

|

0.00

|

1008.26

|

1008.26

|

113019.28

|

100000.00

|

101008.26

|

39

|

2017-12-31

|

0.00

|

0.010083

|

|

14

|

0.00

|

986.23

|

986.23

|

114005.51

|

100000.00

|

100986.23

|

42

|

2018-03-31

|

0.00

|

0.009862

|

|

15

|

0.00

|

997.25

|

997.25

|

115002.76

|

100000.00

|

100997.25

|

45

|

2018-06-30

|

0.00

|

0.009972

|

|

16

|

0.00

|

1008.26

|

1008.26

|

116011.02

|

100000.00

|

101008.26

|

48

|

2018-09-30

|

0.00

|

0.010083

|

|

17

|

0.00

|

1008.26

|

1008.26

|

117019.28

|

100000.00

|

101008.26

|

51

|

2018-12-31

|

0.00

|

0.010083

|

|

18

|

0.00

|

986.23

|

986.23

|

118005.51

|

100000.00

|

100986.23

|

54

|

2019-03-31

|

0.00

|

0.009862

|

|

19

|

0.00

|

997.25

|

997.25

|

119002.76

|

100000.00

|

100997.25

|

57

|

2019-06-30

|

0.00

|

0.009972

|

|

20

|

100000.00

|

1008.26

|

101008.26

|

120011.02

|

0.00

|

101008.26

|

60

|

2019-09-30

|

0.00

|

0.010083

|

See Also