XLeratorDB/financial Documentation

ADJCURRYIELD

Updated: 03 Mar 2017

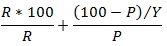

Use the scalar function ADJCURRYIELD to calculate the adjusted current yield for a bond. The formula for the adjusted current yield is:

Where

| R | = | the coupon rate expressed as decimal (1% = .01) |

| P | = | the clean price |

| Y | = | the year fraction from settlement date to maturity date. |

Syntax

SELECT [wct].[ADJCURRYIELD] (

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Price, float,>

,<@Rate, float,>

,<@Basis, nvarchar(4000),>)

Arguments

| Input Name | Description |

| @Settlement | Settlement date of the transaction. @Settlement must be of type datetime or of a type that implicitly converts to datetime. |

| @Maturity | Settlement date of the transaction. @Settlement must be of type datetime or of a type that implicitly converts to datetime. |

| @Price | Clean price. @Price must of a type float or of a type that implicitly converts to float. |

| @Rate | Coupon rate of the instrument expressed as decimal (1% = .01). @Rate must be of type float or of a type that implicitly converts to float. |

| @Basis | The day-count convention used in the calculation of the year fraction from @Settlement to @Maturity. See YEARFRAC for valid day-count conventions. |

Return Types

float

Remarks

- If @Settlement is NULL then @Settlement = GETDATE()

- If @Maturity is NULL then @Maturity = GETDATE()

- If @Price is NULL then @Price = 100

- If @Rate is NULL then @Rate = 0

- If @Basis is NULL then @Basis = 0

- Available in XLeratorDB / financial 2008 only

Examples

SELECT wct.ADJCURRYIELD(

'2017-03-03'

,'2024-04-01'

,101.94

,0.02575

,'ACTUAL'

) as [Adj Curr Yield]

This produces the following result.

See Also