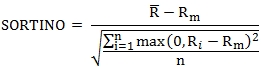

SORTINO

Updated: 21 December 2012

Use SORTINO to calculate the Sortino ratio based upon return data. The Sortino ratio is calculated as the mean difference of the returns (R) and the minimum acceptable return (Rm) divided by the downside deviation. The downside return is calculated where R – Rm < 0.

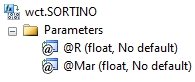

Syntax

Arguments

@R

the return value; the percentage return in floating point format (i.e. 10% = .01). @R is an expression of type float or of a type that can be implicitly converted to float.

@Mar

the minimum acceptable return. @Mar is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

· If there are no negative returns, then SORTINO is NULL.

· @Mar must be the same for all rows in the GROUP BY.

Examples

SELECT wct.SORTINO(R,cast(.15 as float)/cast(52 as float)) as SORTINO

FROM (VALUES

('IBM','2012-12-17',0.0157),

('IBM','2012-12-10',-0.001),

('IBM','2012-12-03',0.0099),

('IBM','2012-11-26',-0.0177),

('IBM','2012-11-19',0.035),

('IBM','2012-11-12',-0.0142),

('IBM','2012-11-05',-0.0153),

('IBM','2012-10-31',0.0008),

('IBM','2012-10-22',-0.0005),

('IBM','2012-10-15',-0.0695),

('IBM','2012-10-08',-0.0133),

('IBM','2012-10-01',0.0151),

('IBM','2012-09-24',0.0072),

('IBM','2012-09-17',-0.004),

('IBM','2012-09-10',0.0367),

('IBM','2012-09-04',0.0239),

('IBM','2012-08-27',-0.0148),

('IBM','2012-08-20',-0.0171),

('IBM','2012-08-13',0.0097),

('IBM','2012-08-06',0.0082),

('IBM','2012-07-30',0.0108),

('IBM','2012-07-23',0.0204),

('IBM','2012-07-16',0.0347),

('IBM','2012-07-09',-0.0282),

('IBM','2012-07-02',-0.0213),

('IBM','2012-06-25',0.0097),

('IBM','2012-06-18',-0.0271),

('IBM','2012-06-11',0.0203),

('IBM','2012-06-04',0.032),

('IBM','2012-05-29',-0.0268),

('IBM','2012-05-21',-0.0081),

('IBM','2012-05-14',-0.0263),

('IBM','2012-05-07',-0.0145),

('IBM','2012-04-30',-0.0088),

('IBM','2012-04-23',0.0361),

('IBM','2012-04-16',-0.0158),

('IBM','2012-04-09',-0.013),

('IBM','2012-04-02',-0.0152),

('IBM','2012-03-26',0.0154),

('IBM','2012-03-19',-0.0026),

('IBM','2012-03-12',0.0269),

('IBM','2012-03-05',0.0091),

('IBM','2012-02-27',0.0053),

('IBM','2012-02-21',0.0224),

('IBM','2012-02-13',0.0052),

('IBM','2012-02-06',-0.0024),

('IBM','2012-01-30',0.0167),

('IBM','2012-01-23',0.0103),

('IBM','2012-01-17',0.0523),

('IBM','2012-01-09',-0.0185),

('IBM','2012-01-03',-0.0073),

('IBM','2011-12-27',-0.0047),

('IBM','2011-12-19',0.0064),

('IBM','2011-12-12',-0.0565),

('IBM','2011-12-05',0.0258)

)n(ticker,wDate,R)

This produces the following result.

SORTINO

----------------------

-0.07417864377595

See Also