StandardBarrierPriceNGreeks

Updated: 31 Oct 2013

Use the table-valued function StandardBarrierPriceNGreeks to calculate the price and Greeks of a European-style Knock-In or Knock-Out option. StandardBarrierPriceNGreeks valuations are based on the formulae published by Mark Rubinstein and Eric Reiner in 1991.

Syntax

SELECT * FROM [wctOptions].[wct].[StandardBarrierPriceNGreeks](

<@CallPut, nvarchar(4000),>

,<@BarrierType, nvarchar(4000),>

,<@AssetPrice, float,>

,<@StrikePrice, float,>

,<@BarrierPrice, float,>

,<@Rebate, float,>

,<@TimeToMaturity, float,>

,<@RiskFreeRate, float,>

,<@DividendRate, float,>

,<@Volatility, float,>)

Arguments

@CallPut

identifies the option as being a call ('C') or a put ('P'). @CallPut is an expression of type nvarchar or of a type that can be implicitly converted to nvarchar.

@BarrierType

identifies the type of barrier as 'UI' (Up-and-In), 'UO' (Up-and-Out), 'DI' (Down-and-In), or 'DO' (Down-and-out). @BarrierType must be of a type nvarchar or of a type that implicitly converts to nvarchar.

@AssetPrice

the price of the underlying asset. @AssetPrice is an expression of type float or of a type that can be implicitly converted to float.

@StrikePrice

the exercise price of the option. @StrikePrice is an expression of type float or of a type that can be implicitly converted to float.

@BarrierPrice

For a knock-in option, @BarrierPrice is the value at which the option comes into existence if the @AssetPrice crosses the barrier. For a knock-out option, @BarrierPrice is the value at which the option is extinguished if the @AssetPrice crosses the barrier. @BarrierPrice must be of a type float or of a type that implicitly converts to float.

@Rebate

An amount paid to the buyer of the option in the event that the barrier is never breached. @Rebate must be of a type float or of a type that implicitly converts to float.

@TimeToMaturity

the time to expiration of the option, expressed in years. @TimeToMaturity is an expression of type float or of a type that can be implicitly converted to float.

@RiskFreeRate

the continuously compounded zero coupon risk-free rate over the life of the option. @RiskFreeRate is an expression of type float or of a type that can be implicitly converted to float.

@DividendRate

the continuously compounded zero coupon dividend rate over the life of the option. For currency options @DividendRate should be the foreign risk-free zero coupon rate. @DividendRate is an expression of type float or of a type that can be implicitly converted to float.

@Volatility

the volatility of the relative price change of the underlying asset. @Volatility is an expression of type float or of a type that can be implicitly converted to float.

Return Type

RETURNS TABLE (

[Price] [float] NULL,

[Delta] [float] NULL,

[Gamma] [float] NULL,

[Theta] [float] NULL,

[Vega] [float] NULL,

[Rho] [float] NULL,

[Lambda] [float] NULL,

[GammaP] [float] NULL,

[DdeltaDtime] [float] NULL,

[DdeltaDvol] [float] NULL,

[DdeltaDvolDvol] [float] NULL,

[DgammaDvol] [float] NULL,

[DvegaDvol] [float] NULL,

[VegaP] [float] NULL,

[PhiRho2] [float] NULL,

[RhoFuturesOption] [float] NULL,

[CarrySensitivity] [float] NULL,

[DgammaDspot] [float] NULL,

[DeltaX] [float] NULL,

[RiskNeutralDensity] [float] NULL,

[DvommaDvol] [float] NULL,

[DgammaDtime] [float] NULL,

[DvegaDtime] [float] NULL,

[ForwardPrice] [float] NULL,

[ForwardPoints] [float] NULL

Unless otherwise specified, the columns returned by StandardBarrierPriceNGreeks are measuring the sensitivity of the theoretical value of the option.

|

Column

|

Description

|

|

Price

|

The theoretical value of the option.

|

|

Delta

|

The sensitivity to small changes in the asset price; the first derivative of the option with respect to price.

|

|

Gamma

|

The rate of change in Delta with respect to small changes in the asset price; the second derivative of the option with respect to price.

|

|

Theta

|

The sensitivity to small changes in time; the first derivative of the option with respect to time.

|

|

Vega

|

The sensitivity to small changes in volatility; the first derivative of the option with respect to volatility.

|

|

Rho

|

The sensitivity to small changes in the risk-free rate; the first derivative of the option with respect to the risk-free rate.

|

|

Lambda

|

Delta multiplied by the asset price divided by the theoretical value. If the theoretical value is zero, then lambda is set to zero.

|

|

GammaP

|

Gamma multiplied by asset price divided by strike price.

|

|

DdeltaDtime

|

The instantaneous change in delta over the passage of time; the second derivative, once to asset price and once to time.

|

|

DdeltaDvol

|

The sensitivity of delta with respect to volatility; the second derivative, once to asset price and once to volatility.

|

|

DdeltaDvolDvol

|

The second derivative of delta with respect to volatility; the third derivative, once to asset price and twice to volatility.

|

|

DgammaDvol

|

The rate of change in gamma with respect to changes in volatility; the third derivative, twice to asset price and once to volatility.

|

|

DvegaDvol

|

The rate of change to Vega as the volatility changes; the second derivative with respect to volatility.

|

|

VegaP

|

The percentage change in theoretical value for a 10 per cent change in volatility.

|

|

PhiRho2

|

The sensitivity to a change in the dividend yield (foreign interest rate for a currency option); the first derivative with respect to dividend yield.

|

|

RhoFuturesOption

|

The sensitivity to a change in the cost-of carry; the first derivative with respect to the cost-of-carry.

|

|

CarrySensitivity

|

-PhiRho2

|

|

DgammaDspot

|

The rate of change in gamma with respect to change in the asset price; the third derivative with respect to price.

|

|

DeltaX

|

The sensitivity to a change in the strike price; the first derivative with respect to strike price.

|

|

RiskNeutralDensity

|

The sensitivity of DeltaX; the second derivative with respect to strike price.

|

|

DvommaDvol

|

The sensitivity of DvegaDvol to changes in volatility; the third derivative, twice to asset price and once to volatility.

|

|

DgammaDtime

|

The sensitivity of Gamma to the passage of time; the third derivative, twice to asset price and once to time.

|

|

DvegaDtime

|

The sensitivity of Vega to the passage of time; the second derivative, once to volatility and once to time.

|

|

ForwardPrice

|

The value of the underlying asset at the expiration date of the option.

|

|

ForwardPoints

|

The difference between the ForwardPrice and the asset price.

|

Remarks

· @Volatility must be greater than zero (@Volatility > 0).

· @TimeToMaturity must be greater than zero (@TimeToMaturity > 0).

· @AssetPrice must be greater than zero (@AssetPrice > 0).

· @StrikePrice must be greater than zero (@StrikePrice > 0).

· If @ReturnValue is NULL, then @ReturnValue is set to 'P'.

· If @DividendRate is NULL then @DividendRate = 0.

· If @RiskFreeRate is NULL @RiskFreeRate = 0.

· @BarrierPrice must be greater than zero (@BarrierPrice > 0).

· @Rebate must be greater than or equal to zero (@Rebate >= 0).

· If @Rebate is NULL, then @Rebate = 0.

· @BarrierPrice assumes continuous monitoring.

· To convert a non-continuous @BarrierPrice use the AdjustedBarrier function.

Example

A down-and-in call

SELECT *

FROM wct.StandardBarrierPriceNGreeks(

'C' --PutCall

,'DI' --BarrierType

,100 --Asset Price

,90 --Strike Price

,97 --Barrier

,2 --Rebate

,0.5 --Time-to-expiry

,.10 --Risk Free Rate

,.05 --Dividend Rate

,.20 --Volatility

)

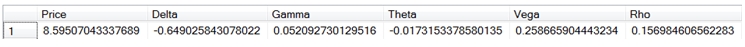

Here are the first few columns of the resultant table.

In this SELECT we un-pivot the columns returned by the function for ease of viewing the results.

SELECT n.*

FROM wct.StandardBarrierPriceNGreeks(

'C' --PutCall

,'DI' --BarrierType

,100 --Asset Price

,90 --Strike Price

,97 --Barrier

,2 --Rebate

,0.5 --Time-to-expiry

,.10 --Risk Free Rate

,.05 --Dividend Rate

,.20 --Volatility

)

CROSS APPLY(VALUES

('Price',Price)

,('Delta',Delta)

,('Gamma',Gamma)

,('Theta',Theta)

,('Vega',Vega)

,('Rho',Rho)

,('Lambda',Lambda)

,('GammaP',GammaP)

,('DdeltaDtime',DdeltaDtime)

,('DdeltaDvol',DdeltaDvol)

,('DdeltaDvolDvol',DdeltaDvolDvol)

,('DgammaDvol',DgammaDvol)

,('DvegaDvol',DvegaDvol)

,('VegaP',VegaP)

,('PhiRho2',PhiRho2)

,('RhoFuturesOption',RhoFuturesOption)

,('CarrySenstivity',CarrySensitivity)

,('DgammaDspot',DgammaDspot)

,('DeltaX',DeltaX)

,('RiskNeutralDensity',RiskNeutralDensity)

,('DvommaDvol',DvommaDvol)

,('DgammaDtime',DgammaDtime)

,('DvegaDtime',DvegaDtime)

,('ForwardPrice',ForwardPrice)

,('ForwardPoints',ForwardPoints)

)n([Return Value], Value)

This produces the following result.

Return Value Value

------------------ ----------------------

Price 8.59507043337689

Delta -0.649025843078022

Gamma 0.052092730129516

Theta -0.0173153378580135

Vega 0.258665904443234

Rho 0.156984606562283

Lambda -7.55114048347627

GammaP 0.052092730129516

DdeltaDtime 0.000306086723699144

DdeltaDvol 0.0135552546964846

DdeltaDvolDvol -0.650285444002208

DgammaDvol -0.00416152983184759

DvegaDvol -0.00199687541169169

VegaP 0.517331808886468

PhiRho2 -0.199959958365525

RhoFuturesOption -0.0379626818828527

CarrySenstivity 0.199959958365525

DgammaDspot 12980.5178819264

DeltaX -0.582783834275347

RiskNeutralDensity 0.0207577954824956

DvommaDvol 0.000564868690799969

DgammaDtime -5.04370755206702E-05

DvegaDtime -0.0699760427380625

ForwardPrice 102.531512052443

ForwardPoints 2.53151205244289

Use CROSS APPLY to with StandardBarrierPriceNGreeks when there are multiple rows of input data.

SELECT n.rn

,k.*

FROM (VALUES

(1,'C','DI',100,97,95,2,0.75,0.005,0.009,0.16)

,(2,'P','DI',100,97,95,2,0.75,0.005,0.009,0.16)

,(3,'C','DO',100,97,95,2,0.75,0.005,0.009,0.16)

,(4,'P','DO',100,97,95,2,0.75,0.005,0.009,0.16)

,(5,'C','UI',100,103,105,2,0.75,0.005,0.009,0.16)

,(6,'P','UI',100,103,105,2,0.75,0.005,0.009,0.16)

,(7,'C','UO',100,103,105,2,0.75,0.005,0.009,0.16)

,(8,'P','UO',100,103,105,2,0.75,0.005,0.009,0.16)

)n(rn,z,bt,S,X,H,K,T,Rf,Rd,Vol)

CROSS APPLY wct.StandardBarrierPriceNGreeks(z,bt,S,X,H,K,T,Rf,Rd,Vol)k

Here are the first few columns of (re-formatted) data in the resultant table.

|

rn

|

Price

|

Delta

|

Gamma

|

Theta

|

Vega

|

Rho

|

Lambda

|

GammaP

|

|

1

|

3.0785

|

-0.1703

|

0.0203

|

-0.0073

|

0.2571

|

0.1310

|

-5.5304

|

0.0203

|

|

2

|

4.6988

|

-0.2909

|

0.0250

|

-0.0090

|

0.2975

|

-0.3016

|

-6.1919

|

0.0250

|

|

3

|

5.7811

|

0.7711

|

0.0074

|

-0.0017

|

0.0742

|

0.2617

|

13.3384

|

0.0074

|

|

4

|

1.4704

|

-0.1015

|

0.0027

|

-0.0010

|

0.0338

|

-0.0304

|

-6.9007

|

0.0027

|

|

5

|

4.6802

|

0.3178

|

0.0252

|

-0.0084

|

0.3057

|

0.2600

|

6.7906

|

0.0252

|

|

6

|

3.4500

|

0.2268

|

0.0246

|

-0.0083

|

0.2793

|

-0.1727

|

6.5750

|

0.0246

|

|

7

|

1.4028

|

0.1140

|

0.0030

|

-0.0009

|

0.0330

|

0.0259

|

8.1272

|

0.0030

|

|

8

|

5.9202

|

-0.7883

|

0.0037

|

-0.0021

|

0.0594

|

-0.3110

|

-13.3153

|

0.0037

|