RunningINFORATIO

Updated: 30 Jun 2013

Use RunningINFORATIO to calculate the information ratio from column values in an ordered resultant table without the need of a self-join. The information ratio is calculated over all the values from the first value to the last value in the ordered group or partition. If the column values are presented to the function out of order, an error message will be generated.

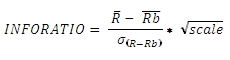

The information ratio is calculated as the mean difference of the returns and a benchmark return divided by the standard deviation of the differences multiplied by the square root of a scaling factor. For daily returns the scale factor might be 252; for weekly returns 52; for monthly returns 12. The standard deviation is the sample standard deviation.

Syntax

SELECT [westclintech].[wct].[RunningINFORATIO](

<@R, float,>

,<@Rb, float,>

,<@Scale, float,>

,<@Prices, bit,>

,<@RowNum, int,>

,<@Id, tinyint,>)

Arguments

@R

the return or price value; if a return value is being supplied, it should be the percentage return in floating point format (i.e. 10% = 0.1). @R is an expression of type float or of a type that can be implicitly converted to float.

@Rb

the benchmark return or price; if a benchmark return is being supplied, is should be the percentage in floating point format (i.e. 10% = 0.1). @Rb is an expression of type float or of a type that can be implicitly converted to float.

@Scale

the scaling factor used in the calculation. @Scale is an expression of type float or of a type that can be implicitly converted to float.

@Prices

a bit value identifying whether the supplied @R and @Rb values are prices (or portfolio values) or returns. If @Prices is true, then the returns are calculated. @Prices is an expression of type bit or of a type that can be implicitly converted to bit.

@RowNum

the number of the row within the group for which the information ratio is being calculated. If @RowNum for the current row in a set is less than or equal to the previous @RowNum and @RowNum is not equal to 1, an error message will be generated. @RowNum is an expression of type int or of a type that can be implicitly converted to int.

@Id

a unique identifier for the RunningINFORATIO calculation. @Id allows you to specify multiple information ratios within a resultant table. @Id is an expression of type tinyint or of a type that can be implicitly converted to tinyint.

Return Type

float

Remarks

· If @Scale IS NULL then @Scale is set to 12.

· If @Prices IS NULL then @Prices is set to 'False'.

Examples

In this example we have 12 months’ worth of return data for and we want to calculate the information ratio.

SELECT CAST(eom as date) as eom

,cast(r as float) as r

,Cast(rb as float) as rb

into #s

FROM (VALUES

('2012-01-31',0.008374,0.008161),

('2012-02-29',0.014544,0.009818),

('2012-03-31',0.010549,0.003224),

('2012-04-30',-0.003218,-0.003088),

('2012-05-31',0.001395,0.008685),

('2012-06-30',0.016985,0.01045),

('2012-07-31',0.007003,0.009179),

('2012-08-31',-0.000834,0.006815),

('2012-09-30',0.009294,0.007383),

('2012-10-31',0.012554,0.009464),

('2012-11-30',0.005767,0.002783),

('2012-12-31',-0.000496,0.005062)

)n(eom,r,rb)

SELECT EOM

,r

,rb

,wct.RunningINFORATIO(

r --@R

,rb --@Rb

,12 --@Scale

,'False' --@Prices

,ROW_NUMBER() OVER (ORDER BY eom ASC) --@RowNum

,NULL --@Id

) as INFO

FROM #s

DROP TABLE #s

This produces the following result.

EOM r rb INFO

---------- ---------------------- ---------------------- ----------------------

2012-01-31 0.008374 0.008161 NULL

2012-02-29 0.014544 0.009818 2.68070681134636

2012-03-31 0.010549 0.003224 3.9351346757467

2012-04-30 -0.003218 -0.003088 2.90540015030581

2012-05-31 0.001395 0.008685 0.601537550348331

2012-06-30 0.016985 0.01045 1.19816250281277

2012-07-31 0.007003 0.009179 0.869687568642996

2012-08-31 -0.000834 0.006815 0.116174630261801

2012-09-30 0.009294 0.007383 0.244792458708043

2012-10-31 0.012554 0.009464 0.436060082807129

2012-11-30 0.005767 0.002783 0.602033363783932

2012-12-31 -0.000496 0.005062 0.225057176618478

In this example we have 13 months’ worth of price data for and we want to calculate the information ratio.

SET NOCOUNT ON

SELECT CAST(eom as date) as eom

,cast(r as money) as r

,Cast(rb as money) as rb

into #s

FROM (VALUES

('2011-12-31',50,100),

('2012-01-31',50.42,100.82),

('2012-02-29',51.15,101.81),

('2012-03-31',51.69,102.13),

('2012-04-30',51.53,101.82),

('2012-05-31',51.6,102.7),

('2012-06-30',52.47,103.78),

('2012-07-31',52.84,104.73),

('2012-08-31',52.8,105.44),

('2012-09-30',53.29,106.22),

('2012-10-31',53.96,107.23),

('2012-11-30',54.27,107.52),

('2012-12-31',54.24,108.07)

)n(eom,r,rb)

SELECT EOM

,r

,rb

,wct.RunningINFORATIO(

r --@R

,rb --@Rb

,12 --@Scale

,'True' --@Prices

,ROW_NUMBER() OVER (ORDER BY eom ASC) --@RowNum

,NULL --@Id

) as INFO

FROM #s

DROP TABLE #s

This produces the following result.

EOM r rb INFO

---------- --------------------- --------------------- ----------------------

2011-12-31 50.00 100.00 NULL

2012-01-31 50.42 100.82 NULL

2012-02-29 51.15 101.81 2.66922905163852

2012-03-31 51.69 102.13 3.89285791187229

2012-04-30 51.53 101.82 2.91747312517382

2012-05-31 51.60 102.70 0.611034090753194

2012-06-30 52.47 103.78 1.19287152750386

2012-07-31 52.84 104.73 0.872234970098944

2012-08-31 52.80 105.44 0.123221418965237

2012-09-30 53.29 106.22 0.250620742602983

2012-10-31 53.96 107.23 0.44162577825319

2012-11-30 54.27 107.52 0.612159825080578

2012-12-31 54.24 108.07 0.224522166142312

In this example we have 13 months’ worth of price data for three different portfolios and we want to calculate the information ratio. Note how each information ratio column in the resultant table has a unique @Id.

SELECT CAST(EOM as date) as EOM

,AAA

,BBB

,CCC

,BMK

INTO #s

FROM (VALUES

('2011-12-31',74.58,49.34,54.97,100),

('2012-01-31',75.17,48.73,56.07,100.82),

('2012-02-29',74.61,49.78,54.66,101.81),

('2012-03-31',74.69,55.25,55.39,102.13),

('2012-04-30',75.6,47.78,57.4,101.82),

('2012-05-31',75.53,50.34,54.92,102.7),

('2012-06-30',75.41,46.81,55.12,103.78),

('2012-07-31',75.83,51.53,55.56,104.73),

('2012-08-31',74.58,52.14,54.24,105.44),

('2012-09-30',74.77,51.22,57.41,106.22),

('2012-10-31',74.33,49.68,55.76,107.23),

('2012-11-30',75.06,45.44,56.28,107.52),

('2012-12-31',75.25,51.96,53.19,108.07)

)n(EOM,AAA,BBB,CCC,BMK)

SELECT EOM

,wct.RunningINFORATIO(AAA, BMK, 12, 'True', ROW_NUMBER() OVER (ORDER BY eom ASC), 1) as AAA

,wct.RunningINFORATIO(BBB, BMK, 12, 'True', ROW_NUMBER() OVER (ORDER BY eom ASC), 2) as BBB

,wct.RunningINFORATIO(CCC, BMK, 12, 'True', ROW_NUMBER() OVER (ORDER BY eom ASC), 3) as CCC

FROM #s

DROP TABLE #s

This produces the following result.

EOM AAA BBB CCC

---------- ---------------------- ---------------------- ----------------------

2011-12-31 NULL NULL NULL

2012-01-31 NULL NULL NULL

2012-02-29 -2.53287857225603 -0.670222203243517 -1.21254057019029

2012-03-31 -2.42887935570662 1.70831447933928 -0.562774128032074

2012-04-30 -0.28751974009322 -0.301132993654973 0.742672111272349

2012-05-31 -0.799672772223789 0.0834332934095227 -0.472794520066031

2012-06-30 -1.31183123925642 -0.468770269560868 -0.559267461050082

2012-07-31 -1.40048556295106 0.122343103745679 -0.543401746270146

2012-08-31 -1.94093672830627 0.142559896617809 -0.93424097466334

2012-09-30 -2.01054132789827 0.00868188486539341 -0.147058345789798

2012-10-31 -2.34529088690404 -0.178729871636421 -0.520105890699677

2012-11-30 -1.86758149549442 -0.535185297725232 -0.431442427795981

2012-12-31 -1.85772821653992 0.0434775121159037 -0.862858177548675

In this example, we have the same data as in the previous example, except that is stored in 3rd normal form rather than in the de-normalized form. The benchmark is included in the table with using the symbol BMK. We use the PARTITION clause in order to generate the correct row number within a symbol.

SELECT CAST(eom as date) as eom

,sym

,CAST(pr as float) as pr

INTO #s

FROM (VALUES

('2011-12-31','AAA',74.58),

('2012-01-31','AAA',75.17),

('2012-02-29','AAA',74.61),

('2012-03-31','AAA',74.69),

('2012-04-30','AAA',75.6),

('2012-05-31','AAA',75.53),

('2012-06-30','AAA',75.41),

('2012-07-31','AAA',75.83),

('2012-08-31','AAA',74.58),

('2012-09-30','AAA',74.77),

('2012-10-31','AAA',74.33),

('2012-11-30','AAA',75.06),

('2012-12-31','AAA',75.25),

('2011-12-31','BBB',49.34),

('2012-01-31','BBB',48.73),

('2012-02-29','BBB',49.78),

('2012-03-31','BBB',55.25),

('2012-04-30','BBB',47.78),

('2012-05-31','BBB',50.34),

('2012-06-30','BBB',46.81),

('2012-07-31','BBB',51.53),

('2012-08-31','BBB',52.14),

('2012-09-30','BBB',51.22),

('2012-10-31','BBB',49.68),

('2012-11-30','BBB',45.44),

('2012-12-31','BBB',51.96),

('2011-12-31','CCC',54.97),

('2012-01-31','CCC',56.07),

('2012-02-29','CCC',54.66),

('2012-03-31','CCC',55.39),

('2012-04-30','CCC',57.4),

('2012-05-31','CCC',54.92),

('2012-06-30','CCC',55.12),

('2012-07-31','CCC',55.56),

('2012-08-31','CCC',54.24),

('2012-09-30','CCC',57.41),

('2012-10-31','CCC',55.76),

('2012-11-30','CCC',56.28),

('2012-12-31','CCC',53.19),

('2011-12-31','BMK',100),

('2012-01-31','BMK',100.82),

('2012-02-29','BMK',101.81),

('2012-03-31','BMK',102.13),

('2012-04-30','BMK',101.82),

('2012-05-31','BMK',102.7),

('2012-06-30','BMK',103.78),

('2012-07-31','BMK',104.73),

('2012-08-31','BMK',105.44),

('2012-09-30','BMK',106.22),

('2012-10-31','BMK',107.23),

('2012-11-30','BMK',107.52),

('2012-12-31','BMK',108.07)

)n(eom,sym,pr)

SELECT s1.EOM

,s1.sym

,wct.RunningINFORATIO(s1.pr, s2.pr, 12, 'True', ROW_NUMBER() OVER (PARTITION BY s1.SYM ORDER BY s1.sym, s1.eom ASC), 1) as INFO

FROM #s s1

JOIN #s s2

ON s1.eom = s2.eom

WHERE s1.sym <> 'BMK'

AND s2.sym = 'BMK'

This produces the following result.

EOM sym INFO

---------- ---- ----------------------

2011-12-31 AAA NULL

2012-01-31 AAA NULL

2012-02-29 AAA -2.53287857225603

2012-03-31 AAA -2.42887935570662

2012-04-30 AAA -0.28751974009322

2012-05-31 AAA -0.799672772223789

2012-06-30 AAA -1.31183123925642

2012-07-31 AAA -1.40048556295106

2012-08-31 AAA -1.94093672830627

2012-09-30 AAA -2.01054132789827

2012-10-31 AAA -2.34529088690404

2012-11-30 AAA -1.86758149549442

2012-12-31 AAA -1.85772821653992

2011-12-31 BBB NULL

2012-01-31 BBB NULL

2012-02-29 BBB -0.670222203243517

2012-03-31 BBB 1.70831447933928

2012-04-30 BBB -0.301132993654973

2012-05-31 BBB 0.0834332934095227

2012-06-30 BBB -0.468770269560868

2012-07-31 BBB 0.122343103745679

2012-08-31 BBB 0.142559896617809

2012-09-30 BBB 0.00868188486539341

2012-10-31 BBB -0.178729871636421

2012-11-30 BBB -0.535185297725232

2012-12-31 BBB 0.0434775121159037

2011-12-31 CCC NULL

2012-01-31 CCC NULL

2012-02-29 CCC -1.21254057019029

2012-03-31 CCC -0.562774128032074

2012-04-30 CCC 0.742672111272349

2012-05-31 CCC -0.472794520066031

2012-06-30 CCC -0.559267461050082

2012-07-31 CCC -0.543401746270146

2012-08-31 CCC -0.93424097466334

2012-09-30 CCC -0.147058345789798

2012-10-31 CCC -0.520105890699677

2012-11-30 CCC -0.431442427795981

2012-12-31 CCC -0.862858177548675

Using the same data, we could PIVOT the results into a tabular format.

SELECT EOM

,AAA

,BBB

,CCC

FROM (

SELECT s1.EOM

,s1.sym

,wct.RunningINFORATIO(s1.pr, s2.pr, 12, 'True', ROW_NUMBER() OVER (PARTITION BY s1.SYM ORDER BY s1.sym, s1.eom ASC), 1) as INFO

FROM #s s1

JOIN #s s2

ON s1.eom = s2.eom

WHERE s1.sym <> 'BMK'

AND s2.sym = 'BMK'

) d

PIVOT(sum(INFO) for sym in(AAA,BBB,CCC))as P

This produces the following result.

EOM AAA BBB CCC

---------- ---------------------- ---------------------- ----------------------

2011-12-31 NULL NULL NULL

2012-01-31 NULL NULL NULL

2012-02-29 -2.53287857225603 -0.670222203243517 -1.21254057019029

2012-03-31 -2.42887935570662 1.70831447933928 -0.562774128032074

2012-04-30 -0.28751974009322 -0.301132993654973 0.742672111272349

2012-05-31 -0.799672772223789 0.0834332934095227 -0.472794520066031

2012-06-30 -1.31183123925642 -0.468770269560868 -0.559267461050082

2012-07-31 -1.40048556295106 0.122343103745679 -0.543401746270146

2012-08-31 -1.94093672830627 0.142559896617809 -0.93424097466334

2012-09-30 -2.01054132789827 0.00868188486539341 -0.147058345789798

2012-10-31 -2.34529088690404 -0.178729871636421 -0.520105890699677

2012-11-30 -1.86758149549442 -0.535185297725232 -0.431442427795981

2012-12-31 -1.85772821653992 0.0434775121159037 -0.862858177548675