Calculating the beta of a stock or portfolio in SQL Server

Jan

23

Written by:

Charles Flock

1/23/2013 11:57 AM

In this article we look at how moving a traditional spreadsheet calculation into SQL Server simplifies the calculation while also allowing you to analyze more data in more different ways than you would think possible

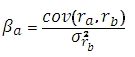

The formula for calculating the beta of a stock or portfolio is:

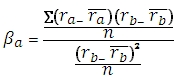

Where ra is the return of the asset and rb is the return of the portfolio benchmark. Substituting some of the terms, gives us the following equation:

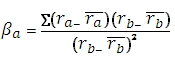

Of course, n cancels out in the numerator and denominator, leaving us with the following equation:

which just happens to be the definition of the SLOPE function. Thus the beta of a stock or portfolio is the SLOPE of the asset returns and the benchmark returns. Let’s look at an example.

SELECT wct.COVAR(Ra, Rb) / VARP(Rb) as Beta

,wct.SLOPE(Ra, Rb) as Slope

FROM (VALUES

('2013-01-02',-0.060451,0.041923),

('2012-12-03',-0.090743,0.007068),

('2012-11-01',-0.012369,0.002847),

('2012-10-01',-0.107609,-0.019789),

('2012-09-04',0.002794,0.024236),

('2012-08-01',0.093891,0.019763),

('2012-07-02',0.045814,0.012598),

('2012-06-01',0.010862,0.039555),

('2012-05-01',-0.010711,-0.062651),

('2012-04-02',-0.025965,-0.007497),

('2012-03-01',0.105269,0.031332),

('2012-02-01',0.188326,0.040589),

('2012-01-03',0.127092,0.043583),

('2011-12-01',0.059656,0.008533),

('2011-11-01',-0.05578,-0.005059),

('2011-10-03',0.061541,0.107723),

('2011-09-01',-0.009123,-0.071762),

('2011-08-01',-0.014469,-0.056791),

('2011-07-01',0.16326,-0.021474),

('2011-06-01',-0.034951,-0.018258),

('2011-05-02',-0.00657,-0.013501),

('2011-04-01',0.004661,0.028495),

('2011-03-01',-0.01331,-0.001047),

('2011-02-01',0.040942,0.031957),

('2011-01-03',0.051952,0.022646),

('2010-12-01',0.036672,0.0653),

('2010-11-01',0.033788,-0.00229),

('2010-10-01',0.060729,0.036856),

('2010-09-01',0.167206,0.087551),

('2010-08-02',-0.055022,-0.047449),

('2010-07-01',0.022742,0.068778),

('2010-06-01',-0.020815,-0.053882),

('2010-05-03',-0.016113,-0.081976),

('2010-04-01',0.11102,0.014759),

('2010-03-01',0.148457,0.058796),

('2010-02-01',0.065399,0.028514),

('2010-01-04',-0.088615,-0.036974),

('2009-12-01',0.054151,0.017771),

('2009-11-02',0.060533,0.057364),

('2009-10-01',0.016982,-0.019762),

('2009-09-01',0.101901,0.035723),

('2009-08-03',0.029515,0.03356),

('2009-07-01',0.147117,0.074142),

('2009-06-01',0.048808,0.000196),

('2009-05-01',0.079298,0.053081),

('2009-04-01',0.197044,0.093925),

('2009-03-02',0.177022,0.085405),

('2009-02-02',-0.009178,-0.109931),

('2009-01-02',0.056028,-0.085657)

)n(tDate, Ra, Rb)

This produces the following result.

Beta Slope

---------------------- ----------------------

0.86600592673868 0.86600592673868

As you can see the Beta and the SLOPE are the same.

Interpreting the Beta value is beyond the scope of this article, as we are concerned with the mechanics of the beta calculation, especially for many assets and benchmarks at the same time. However, it is very important to note that Beta is a measure that compares returns not prices. This leaves us with the not-so-small task of calculating the returns. The math for the return calculation is straightforward enough.

Where Pt is the price (or value) of the asset at time t.

If you are a SQL Server 2008 user, you can use the XLeratorDB LAG function to do this calculation. SQL Server 2012 users can use the LAG function in SQL Server 2012. Here’s an example, using the price data to calculate the return values used in the previous example.

SELECT tDate

,ROUND(Pa / wct.LAG(Pa,1,NULL,ROW_NUMBER() OVER (ORDER BY tDate),0) - 1, 6) as Ra

,ROUND(Pb / wct.LAG(Pb,1,NULL,ROW_NUMBER() OVER (ORDER BY tDate),1) - 1, 6) as Rb

FROM (VALUES

('2013-01-02',500,1485.98),

('2012-12-03',532.17,1426.19),

('2012-11-01',585.28,1416.18),

('2012-10-01',592.61,1412.16),

('2012-09-04',664.07,1440.67),

('2012-08-01',662.22,1406.58),

('2012-07-02',605.38,1379.32),

('2012-06-01',578.86,1362.16),

('2012-05-01',572.64,1310.33),

('2012-04-02',578.84,1397.91),

('2012-03-01',594.27,1408.47),

('2012-02-01',537.67,1365.68),

('2012-01-03',452.46,1312.41),

('2011-12-01',401.44,1257.6),

('2011-11-01',378.84,1246.96),

('2011-10-03',401.22,1253.3),

('2011-09-01',377.96,1131.42),

('2011-08-01',381.44,1218.89),

('2011-07-01',387.04,1292.28),

('2011-06-01',332.72,1320.64),

('2011-05-02',344.77,1345.2),

('2011-04-01',347.05,1363.61),

('2011-03-01',345.44,1325.83),

('2011-02-01',350.1,1327.22),

('2011-01-03',336.33,1286.12),

('2010-12-01',319.72,1257.64),

('2010-11-01',308.41,1180.55),

('2010-10-01',298.33,1183.26),

('2010-09-01',281.25,1141.2),

('2010-08-02',240.96,1049.33),

('2010-07-01',254.99,1101.6),

('2010-06-01',249.32,1030.71),

('2010-05-03',254.62,1089.41),

('2010-04-01',258.79,1186.69),

('2010-03-01',232.93,1169.43),

('2010-02-01',202.82,1104.49),

('2010-01-04',190.37,1073.87),

('2009-12-01',208.88,1115.1),

('2009-11-02',198.15,1095.63),

('2009-10-01',186.84,1036.19),

('2009-09-01',183.72,1057.08),

('2009-08-03',166.73,1020.62),

('2009-07-01',161.95,987.48),

('2009-06-01',141.18,919.32),

('2009-05-01',134.61,919.14),

('2009-04-01',124.72,872.81),

('2009-03-02',104.19,797.87),

('2009-02-02',88.52,735.09),

('2009-01-02',89.34,825.88),

('2008-12-08',84.6,903.25)

)n(tDate, Pa, Pb)

This produces the following result.

tDate Ra Rb

---------- ---------------------- ----------------------

2008-12-08 NULL NULL

2009-01-02 0.056028 -0.085657

2009-02-02 -0.009178 -0.109931

2009-03-02 0.177022 0.085405

2009-04-01 0.197044 0.093925

2009-05-01 0.079298 0.053081

2009-06-01 0.048808 0.000196

2009-07-01 0.147117 0.074142

2009-08-03 0.029515 0.03356

2009-09-01 0.101901 0.035723

2009-10-01 0.016982 -0.019762

2009-11-02 0.060533 0.057364

2009-12-01 0.054151 0.017771

2010-01-04 -0.088615 -0.036974

2010-02-01 0.065399 0.028514

2010-03-01 0.148457 0.058796

2010-04-01 0.11102 0.014759

2010-05-03 -0.016113 -0.081976

2010-06-01 -0.020815 -0.053882

2010-07-01 0.022742 0.068778

2010-08-02 -0.055022 -0.047449

2010-09-01 0.167206 0.087551

2010-10-01 0.060729 0.036856

2010-11-01 0.033788 -0.00229

2010-12-01 0.036672 0.0653

2011-01-03 0.051952 0.022646

2011-02-01 0.040942 0.031957

2011-03-01 -0.01331 -0.001047

2011-04-01 0.004661 0.028495

2011-05-02 -0.00657 -0.013501

2011-06-01 -0.034951 -0.018258

2011-07-01 0.16326 -0.021474

2011-08-01 -0.014469 -0.056791

2011-09-01 -0.009123 -0.071762

2011-10-03 0.061541 0.107723

2011-11-01 -0.05578 -0.005059

2011-12-01 0.059656 0.008533

2012-01-03 0.127092 0.043583

2012-02-01 0.188326 0.040589

2012-03-01 0.105269 0.031332

2012-04-02 -0.025965 -0.007497

2012-05-01 -0.010711 -0.062651

2012-06-01 0.010862 0.039555

2012-07-02 0.045814 0.012598

2012-08-01 0.093891 0.019763

2012-09-04 0.002794 0.024236

2012-10-01 -0.107609 -0.019789

2012-11-01 -0.012369 0.002847

2012-12-03 -0.090743 0.007068

2013-01-02 -0.060451 0.041923

It would seem straightforward, then, that we could change our SELECT statement slightly and use the SLOPE function to calculate the beta directly from the price data. But, when we do that, we generate an error message.

SELECT wct.SLOPE(

ROUND(Pa / wct.LAG(Pa,1,NULL,ROW_NUMBER() OVER (ORDER BY tDate),0) - 1, 6)

,ROUND(Pb / wct.LAG(Pb,1,NULL,ROW_NUMBER() OVER (ORDER BY tDate),1) - 1, 6)

)

This produces the following error message.

.Net SqlClient Data Provider: Msg 4109, Level 15, State 1, Line 2

Windowed functions cannot be used in the context of another windowed function or aggregate.

We get the same message in SQL Server 2012 using the built-in LAG function.

SELECT wct.SLOPE(

ROUND(Pa / LAG(Pa) OVER (ORDER BY tDate) - 1, 6)

,ROUND(Pb / LAG(Pb) OVER (ORDER BY tDate) - 1, 6)

)

This produces the following result.

Msg 4109, Level 15, State 1, Line 2

Windowed functions cannot be used in the context of another windowed function or aggregate.

Faced with this limitation, we implemented the EQBETA function, which will calculate the beta from the price data.[1] The EQBETA function makes things really simple, taking in the price data, converting it to return data, and then calculating the SLOPE. This makes the SQL very simple and straightforward.

SELECT wct.EQBETA(tdate, Pa, Pb) as Beta

FROM (VALUES

('2013-01-02',500,1485.98),

('2012-12-03',532.17,1426.19),

('2012-11-01',585.28,1416.18),

('2012-10-01',592.61,1412.16),

('2012-09-04',664.07,1440.67),

('2012-08-01',662.22,1406.58),

('2012-07-02',605.38,1379.32),

('2012-06-01',578.86,1362.16),

('2012-05-01',572.64,1310.33),

('2012-04-02',578.84,1397.91),

('2012-03-01',594.27,1408.47),

('2012-02-01',537.67,1365.68),

('2012-01-03',452.46,1312.41),

('2011-12-01',401.44,1257.6),

('2011-11-01',378.84,1246.96),

('2011-10-03',401.22,1253.3),

('2011-09-01',377.96,1131.42),

('2011-08-01',381.44,1218.89),

('2011-07-01',387.04,1292.28),

('2011-06-01',332.72,1320.64),

('2011-05-02',344.77,1345.2),

('2011-04-01',347.05,1363.61),

('2011-03-01',345.44,1325.83),

('2011-02-01',350.1,1327.22),

('2011-01-03',336.33,1286.12),

('2010-12-01',319.72,1257.64),

('2010-11-01',308.41,1180.55),

('2010-10-01',298.33,1183.26),

('2010-09-01',281.25,1141.2),

('2010-08-02',240.96,1049.33),

('2010-07-01',254.99,1101.6),

('2010-06-01',249.32,1030.71),

('2010-05-03',254.62,1089.41),

('2010-04-01',258.79,1186.69),

('2010-03-01',232.93,1169.43),

('2010-02-01',202.82,1104.49),

('2010-01-04',190.37,1073.87),

('2009-12-01',208.88,1115.1),

('2009-11-02',198.15,1095.63),

('2009-10-01',186.84,1036.19),

('2009-09-01',183.72,1057.08),

('2009-08-03',166.73,1020.62),

('2009-07-01',161.95,987.48),

('2009-06-01',141.18,919.32),

('2009-05-01',134.61,919.14),

('2009-04-01',124.72,872.81),

('2009-03-02',104.19,797.87),

('2009-02-02',88.52,735.09),

('2009-01-02',89.34,825.88),

('2008-12-08',84.6,903.25)

)n(tDate, Pa, Pb)

This produces the following result.

Beta

----------------------

0.866005982032534

Having the EQBETA function lets us do some interesting things. We have created a very simple table called eqprices, which contains a ticker, a date, and a price. Then we randomly generated 1.637 million rows of data. Part of the data is the indexes against which we want to benchmark, which have tickers of SPX, COMP, and DJIA. The key to the table is ticker and date. In this statement, we calculate the beta for all 500 tickers using prices from 2012-Jan-01 onward.

SELECT e1.ticker

,wct.EQBETA(e1.tdate,e2.price_closing,e1.price_closing) as beta

FROM eqprices e1

JOIN eqprices e2

ON e2.ticker = 'SPX'

AND e1.ticker <> 'SPX'

AND e1.tdate = e2.tdate

AND e1.tdate > '2012-01-01'

GROUP BY e1.ticker

ORDER BY 1

Here are are the first few rows returned by the SELECT.

And here are the statistics generated by the statement.

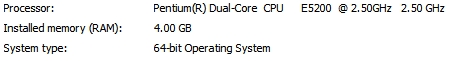

As you can see, the total execution time was 1242 milliseconds; a little more than a second. And very little data moved back and forth; all the calculations are done on the database. If you’re interested, I did this in SQL Server 2008 R2 with the following machine:

Essentially, this makes the calculation of beta a trivial exercise. In this example we will compare the 1-year and 3-year betas.

SELECT *

FROM (

SELECT e1.ticker

,1 AS yr

,wct.EQBETA(e1.tdate,e2.price_closing,e1.price_closing) as [BETA]

FROM eqprices e1

JOIN eqprices e2

ON e2.ticker = 'COMP'

AND e1.ticker <> 'COMP'

AND e1.tdate = e2.tdate

AND e1.tdate > DATEADD(yy,-1,'2012-12-10')

GROUP BY e1.ticker

UNION ALL

SELECT e1.ticker

,3

,wct.EQBETA(e1.tdate,e2.price_closing,e1.price_closing) as [BETA]

FROM eqprices e1

JOIN eqprices e2

ON e2.ticker = 'COMP'

AND e1.ticker <> 'COMP'

AND e1.tdate = e2.tdate

AND e1.tdate > DATEADD(yy,-3,'2012-12-10')

GROUP BY e1.ticker

) d

PIVOT(SUM(BETA) FOR YR in([1],[3])) p

Here are the first few rows returned by the statement.

Ticker 1 3

------ ---------------------- ----------------------

AAPL 0.000528774432742821 0.000215904529669967

ABC 0.000182397495347866 -3.24081991621297E-05

ABT -0.000181830782491652 -0.000237210203976776

ACN 0.000340978117436343 -8.0011175435327E-05

ADI 2.28440291047768E-05 -0.000126471901695446

ADP 0.000229319494989254 -0.000208379877589705

ADSK 0.000332881423336462 0.000122985748424428

AEE -5.43281821282431E-05 -1.87492484463807E-05

AET 0.000318655916427984 -0.000467593446370447

AIV -1.07136028956299E-05 -0.000176516458497995

ALL 0.000173155734607894 5.42232046111245E-05

AMD 4.11487375122197E-05 -6.38008640377941E-05

AMGN -0.000511500572982186 -8.55573771463149E-06

AMT 5.26011740458716E-05 -8.7465886377795E-05

AMZN -0.000375288599107781 -0.000415651363119432

AN -0.000149609906378837 -0.000187809955072543

AON -0.000373286712898433 -0.000306074496281714

APH -4.71289519772561E-05 -8.76167743634843E-05

ATI 0.000366154256857682 0.000268443744337173

AVB -0.00021712719685472 0.000242470277203392

AVP 0.000145701364842811 -0.000145276357886447

AVY -0.000125384582922887 8.78985919606747E-05

AXP 0.000227156771000262 0.000175801041161843

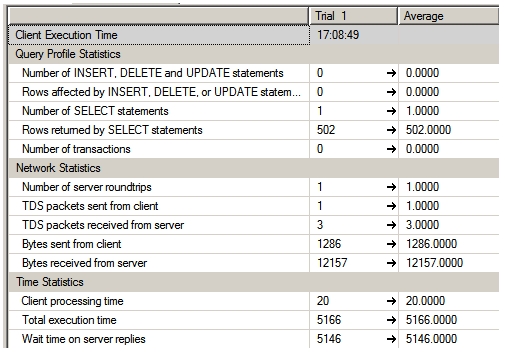

Here are the client statistics.

Again, very little data moving around and a response of just a little over 5 second (5,166 milliseconds).

There is one other very interesting aspect of implementing the EQBETA function in SQL Server. Let’s assume that you want to evaluate multiple portfolios against the S&P 500. We will keep this example simple, with 5 portfolios having valuations for the last 12 months. We put the closing prices for three benchmarks in a separate table.

SELECT *

INTO #p

FROM (VALUES

('A','2012-12-31',1619488.45), ('B','2012-12-31',1733551.06), ('C','2012-12-31',1139347.79), ('D','2012-12-31',1220850.78), ('E','2012-12-31',1709084.06), ('A','2012-11-30',1548974.65), ('B','2012-11-30',1652066.38), ('C','2012-11-30',1092770.75), ('D','2012-11-30',1169707.78), ('E','2012-11-30',1653648.97),

('A','2012-10-31',1534294.05), ('B','2012-10-31',1645536.38), ('C','2012-10-31',1087152.01), ('D','2012-10-31',1157360.70), ('E','2012-10-31',1641716.47), ('A','2012-09-30',1530396.59), ('B','2012-09-30',1652565.23), ('C','2012-09-30',1087645.04), ('D','2012-09-30',1145962.15), ('E','2012-09-30',1643447.51),

('A','2012-08-31',1553843.15), ('B','2012-08-31',1701551.89), ('C','2012-08-31',1116895.87), ('D','2012-08-31',1163873.47), ('E','2012-08-31',1669982.53), ('A','2012-07-31',1515595.45), ('B','2012-07-31',1650972.55), ('C','2012-07-31',1100567.75), ('D','2012-07-31',1126653.25), ('E','2012-07-31',1625546.45),

('A','2012-06-30',1498418.53), ('B','2012-06-30',1633876.71), ('C','2012-06-30',1072507.35), ('D','2012-06-30',1108187.13), ('E','2012-06-30',1592793.26), ('A','2012-05-31',1482852.09), ('B','2012-05-31',1621556.70), ('C','2012-05-31',1063470.37), ('D','2012-05-31',1102128.03), ('E','2012-05-31',1588032.91),

('A','2012-04-30',1431248.54), ('B','2012-04-30',1567243.99), ('C','2012-04-30',1024483.72), ('D','2012-04-30',1057750.20), ('E','2012-04-30',1516087.12), ('A','2012-03-31',1527399.35), ('B','2012-03-31',1663124.21), ('C','2012-03-31',1093775.11), ('D','2012-03-31',1118780.43), ('E','2012-03-31',1631518.12),

('A','2012-02-29',1541733.61), ('B','2012-02-29',1686221.23), ('C','2012-02-29',1110428.76), ('D','2012-02-29',1122144.05), ('E','2012-02-29',1656863.99), ('A','2012-01-31',1481677.70), ('B','2012-01-31',1631354.88), ('C','2012-01-31',1078261.65), ('D','2012-01-31',1081029.91), ('E','2012-01-31',1592935.70),

('A','2011-12-31',1433249.00), ('B','2011-12-31',1563365.00), ('C','2011-12-31',1045243.00), ('D','2011-12-31',1034093.00), ('E','2011-12-31',1545505.00)

)n(port,tDate,val)

SELECT *

INTO #b

FROM (VALUES

('SPX','2012-12-31',1485.98),

('SPX','2012-11-30',1426.19),

('SPX','2012-10-31',1416.18),

('SPX','2012-09-30',1412.16),

('SPX','2012-08-31',1440.67),

('SPX','2012-07-31',1406.58),

('SPX','2012-06-30',1379.32),

('SPX','2012-05-31',1362.16),

('SPX','2012-04-30',1310.33),

('SPX','2012-03-31',1397.91),

('SPX','2012-02-29',1408.47),

('SPX','2012-01-31',1365.68),

('SPX','2011-12-31',1312.41),

('COMP','2012-12-31',3091.33),

('COMP','2012-11-30',3029.21),

('COMP','2012-10-31',2987.54),

('COMP','2012-09-30',3130.31),

('COMP','2012-08-31',3063.25),

('COMP','2012-07-31',2956.72),

('COMP','2012-06-30',2938.41),

('COMP','2012-05-31',2810.13),

('COMP','2012-04-30',3044.79),

('COMP','2012-03-31',3085.94),

('COMP','2012-02-29',2979.11),

('COMP','2012-01-31',2830.10),

('COMP','2011-12-31',2657.39),

('DJIA','2012-12-31',13104.3),

('DJIA','2012-11-30',13027.73),

('DJIA','2012-10-31',13099.19),

('DJIA','2012-09-30',13437.66),

('DJIA','2012-08-31',13092.15),

('DJIA','2012-07-31',13007.47),

('DJIA','2012-06-30',12879.71),

('DJIA','2012-05-31',12391.56),

('DJIA','2012-04-30',13214.16),

('DJIA','2012-03-31',13211.36),

('DJIA','2012-02-29',12952.29),

('DJIA','2012-01-31',12632.76),

('DJIA','2011-12-31',12221.19)

)m(ticker,tDate,pr)

The calculation of the beta for each of the portfolios is straightforward. We will use SPX as the benchmark.

SELECT #p.port

,wct.EQBETA(#p.tDate,#p.val,#b.pr) as Beta

FROM #p

JOIN #b

ON #b.tDate = #p.tDate

AND #b.ticker = 'SPX'

GROUP BY #p.port

ORDER BY 1

This produces the following result.

port Beta

---- ----------------------

A 0.983910724951417

B 1.03034658060587

C 1.002214561704

D 0.960458214873104

E 1.05265687457901

What if we wanted to calculate the beta across all portfolios? This is extremely easy using the EQBETA function.

SELECT wct.EQBETA(#p.tDate,#p.val,#b.pr) as Beta

FROM #p

JOIN #b

ON #b.tDate = #p.tDate

AND #b.ticker = 'SPX'

This produces the following result.

Beta

----------------------

1.0095843955307

In this example, we calculate the beta for each portfolio against different benchmarks.

SELECT #p.port

,#b.ticker

,wct.EQBETA(#p.tDate,#p.val,#b.pr) as Beta

FROM #p

JOIN #b

ON #b.tDate = #p.tDate

GROUP BY #p.port

,#b.ticker

ORDER BY 2,1

This produces the following result.

port ticker Beta

---- ------ ----------------------

A COMP 0.128316121199841

B COMP 0.152866971810549

C COMP 0.0658973826059795

D COMP 0.0967770193579477

E COMP 0.0607068953214639

A DJIA -0.0724662101118738

B DJIA -0.0677773954868839

C DJIA -0.1382399115682

D DJIA -0.1290499027521

E DJIA -0.187291358877354

A SPX 0.983910724951417

B SPX 1.03034658060587

C SPX 1.002214561704

D SPX 0.960458214873104

E SPX 1.05265687457901

We can use PIVOT to look at the results side-by-side.

SELECT *

FROM (

SELECT #p.port

,#b.ticker

,wct.EQBETA(#p.tDate,#p.val,#b.pr) as Beta

FROM #p

JOIN #b

ON #b.tDate = #p.tDate

GROUP BY #p.port

,#b.ticker

) d

PIVOT(SUM(BETA) FOR ticker in(COMP,DJIA,SPX)) p

This produces the following result.

port COMP DJIA SPX

---- ---------------------- ---------------------- ----------------------

A 0.128316121199841 -0.0724662101118738 0.983910724951417

B 0.152866971810549 -0.0677773954868839 1.03034658060587

C 0.0658973826059795 -0.1382399115682 1.002214561704

D 0.0967770193579477 -0.1290499027521 0.960458214873104

E 0.0607068953214639 -0.187291358877354 1.05265687457901

Finally, we can look at all portfolios against each of the benchmarks.

SELECT #b.ticker

,wct.EQBETA(#p.tDate,#p.val,#b.pr) as Beta

FROM #p

JOIN #b

ON #b.tDate = #p.tDate

GROUP BY #b.ticker

ORDER BY 1

This produces the following result.

ticker Beta

------ ----------------------

COMP 0.103462228945628

DJIA -0.117485238733587

SPX 1.0095843955307

The EQBETA function can be an important tool in equity analysis, along with the hundreds of other financial, statistical, and mathematical functions in XLeratorDB. If you are interested in trying this out for yourself, download the 15-day free trial today and let us know what you think.

[1] Why didn’t we call this the BETA function? We already have a BETA function which calculates Γ(a)Γ(b)/Γ(a+b).